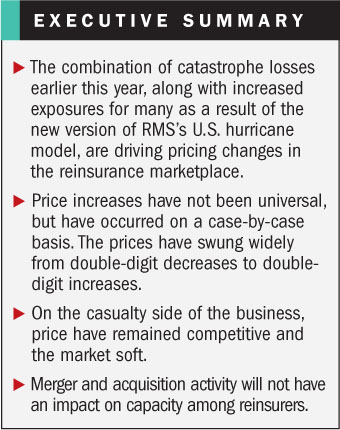

The soft market remains firmly entrenched on the casualty side of the reinsurance business, with pricing still weak across the board, according to reinsurance brokers.

“The casualty insurance market remains extremely competitive,” says Jim Bradshaw, CEO for Willis Re Inc.

But the property and catastrophe marketplace is a much different—and more unsettled—story.

But the property and catastrophe marketplace is a much different—and more unsettled—story.

Pricing for this year's reinsurance renewals at June 1 was quite “volatile,” according to reinsurance broker Guy Carpenter—with prices seeing both double-digit decreases and increases.

In a report titled “Wide Range of Outcomes Seen in June 1, 2011, Florida Reinsurance Renewals,” the broker described an environment where price changes in the Sunshine State “could be reported anywhere from down 15 percent to up 10 percent.”

According to the Guy Carpenter report, the two factors fueling this fluctuation are the record first-half catastrophe losses around the world and “uncertainty surrounding the release” of the Risk Management Solutions Version 11 U.S. hurricane model.

Seconding the findings in the Guy Carpenter report of a mercurial market, James Kent, president of Willis Re Inc., says he also is seeing a lot of variation in pricing, from decreases to increases.

In Kent's assessment, large national programs are experiencing more of the increases because they present a more challenging portfolio of risk to the markets.

MODEL AS MARKET MOVER

Many market watchers may have assumed that the recent slew of significant natural catastrophes in Japan, Australia and New Zealand would put upward pressure on the U.S. reinsurance market. And the loss of capacity brought on by overseas events is having some impact—but it's limited.

Figuring more prominently in any of the pricing increases being experienced is the reevaluation of loss exposure presented by the revised hurricane-catastrophe model, RMS V.11—this has been the biggest driver of pricing changes at the midyear renewals, according to Bradshaw.

Lara Mowery, head of global property specialty for Guy Carpenter, a subsidiary of Marsh & McLennan Cos. that also owns insurance broker Marsh, agrees that the catastrophe losses so far this year have not been enough on their own to move the market.

Lara Mowery, head of global property specialty for Guy Carpenter, a subsidiary of Marsh & McLennan Cos. that also owns insurance broker Marsh, agrees that the catastrophe losses so far this year have not been enough on their own to move the market.

But the losses, coupled with the RMS-model revisions—which are producing sometimes significantly increased risk exposures—have produced increases in prices, Mowery says, as insurers and reinsurers consider how much capital they need to hold against the risks they underwrite.

“It's the accumulation of losses as well as the impact of the version release” that account for the market shift, says Mowery.

Bradshaw, for his part, isn't unduly perturbed by these shifts in pricing direction; he characterizes the market as “behaving in a very rational manner.”

Adds Mowery: “While we have not finished analysis of the July renewals, we do not anticipate that the results will be out of line from what we've seen in the past couple of months.”

CASE-BY-CASE BASIS

Brokers stress that increases are occurring on a case-by-case basis—higher prices are not being seen universally.

And while the price bumps are coming as a surprise to some buyers, others anticipated the changes the model would bring and built the increased cost for risk into their budgets.

John Daum, executive director for Lockton Re, says that despite the changes brought on by the model revision, it was a “quite rewarding” June renewal season as brokers were able to “manage clients' expectations properly.”

He says his clients were aware of the changes and budgeted accordingly. “We actually thought [pricing] could change more, but it was not as significant as anticipated,” says Daum.

[Some other areas where Daum believes upward pricing movements should be anticipated are workers' compensation as hiring increases; some Northeast hurricane] exposures; and industrial-loss warranty that insures gaps in programs.]

Of course, it must also be pointed out that all these pricing negotiations took place before the start of this year's hurricane season. And should the industry suffer some severe wind losses this year—on top of the April and May storm losses and overseas disasters—it could have significant impact on the market's direction come the January 2012 reinsurance renewal period.

CATASTROPHE CONTROVERSY

Brokers say that in some cases, reinsurers have balked at the damage calculations made by the revised RMS model . They are questioning some of the scientific assumptions and have begun blending other models to come up with what is to them a more satisfying and justifiable conclusion to risk exposure.

. They are questioning some of the scientific assumptions and have begun blending other models to come up with what is to them a more satisfying and justifiable conclusion to risk exposure.

Daum says the controversy over the new RMS model has resulted in competitor AIR Worldwide picking up some new clients and in users blending models—and Daum believes this shift to utilizing two or more catastrophe models in underwriting risk is a good development for the industry.

He adds that another benefit of the new model is that it has forced reinsurance clients “to improve the quality of their [submissions]” to ensure the information underwriters have is complete and accurate, “which is always good.”

In an e-mail reply to a question about the RMS model, Mowery notes that RMS “provided guidance prior to the version release; however, results in many cases were higher than the guidance provided by RMS would have indicated.”

In an e-mail, Claire Souch, vice president at RMS, says that the models “evolve over time” through scientific research and actual events, “which can sometimes reveal previously hidden flaws in the building stock.” The RMS V.11, the latest in a long series of updates over the years, is based on “new data and extensive research,” including research conducted with the University of Miami and more wind observations than in previous models. It also includes “more insight into construction quality of buildings in different regions of the U.S.”

Souch notes that catastrophe models are “one of a suite of tools” used by insurers and reinsurers to set prices. She says that the forces of supply and demand can have more influence on pricing than model changes. The global-catastrophe losses, including major tornadoes in the United States, “are all contributing to pricing volatility this year.”

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.