NU Online News Service, June 30, 12:17 p.m. EST

State Auto Insurance Cos. will no longer be writing new automobile and homeowners’ insurance in Rhode Island, and is putting an end to its homeowners business in Massachusetts.

State Auto Insurance Cos. will no longer be writing new automobile and homeowners’ insurance in Rhode Island, and is putting an end to its homeowners business in Massachusetts.

To fill some of the void, Rhode Island-based Narragansett Bay Insurance Co. (NBIC) says it has entered into an agreement with State Auto to offer home insurance renewal policies to State Auto's 10,000 customers in the effcted states.

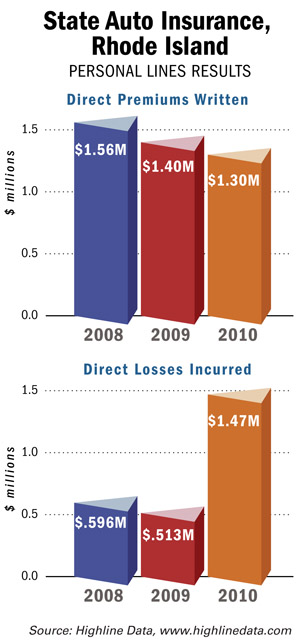

State Auto will continue to write business and farm insurance in Massachusetts (it doesn't write auto in the state) but it is stopping all lines in Rhode Island, says Charles McShane Jr., president of the Eastern Region for State Auto, in a statement. About $9 million in premiums are being left behind.

Jeff Hunt, executive vice president of business development for Narragansett, says these types of transactions, along with organic growth, have allowed the Rhode Island, Massachusetts, New York and New Jersey property insurer to grow rapidly.

“Of the policies State Auto is leaving in Rhode Island, about 80 percent are with agents that have a relationship with us,” Hunt says. “In Massachusetts this allows us to create new agent partners in the western part of the state.”

Kyle Anderson, spokesman for State Auto, says the decision to leave Rhode Island and the property market in Massachusetts has nothing to do with the insurer’s hefty second-quarter catastrophe losses or the recent downgrade of its financial strength rating by A.M. Best Co.

“The fact is we did not have much penetration in these states,” Anderson says. “We need to focus our efforts on areas where we can have more impact, growth and success. This is not a knock on Rhode Island.”

State Auto says it has told its independent agents of its plans. In a statement the Massachusetts Association of Insurance Agents and the Independent Insurance Agents of Rhode Island say they “recognize that there continues to be consolidation and market entrenchment especially in coastal states. We encouraged and applaud NBIC and State Auto for working together to develop a cooperative solution for the independent agents and their customers.”

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.