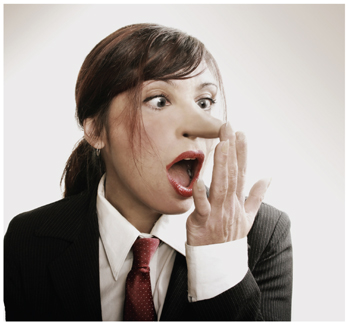

Paul Colbert has seen it all, from allegedly crippled people walking again and the infirmed riding horses to the blind seeing again, as if by divine intervention. While the investigator and founder of Meridian Investigative Group acknowledges the entertainment factor of some of these outlandish cases, his overarching concern is that people, authorities especially, simply do not take workers' compensation fraud seriously. Recently Colbert spoke with Claims Editor in Chief Christina Bramlet about how this type of fraud weighs on the P&C insurance community, how to deter it, and why we all have a lot at stake.

Are fraudsters becoming more brazen? If so, then is the current scarcity of jobs a significant factor?

Absolutely—fraud is on the rise and with more and more personal injury attorneys entering the marketplace, there certainly is no shortage of brazen claimants out there willing to take a crack at the workers' comp system in particular. I think the reason these individuals are so bold is that often times they actually feel they are entitled to a claim. The negative stereotype that all insurance companies are greedy is alive and well in the U.S. Many presume that insurers are “out to take [their] money,” adding even more fuel to the fire when it comes to actually filing a claim.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.