They Say, Hearsay

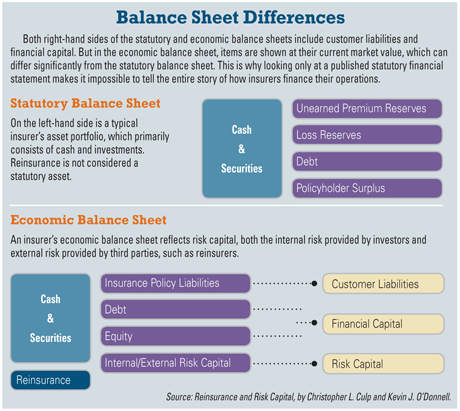

I read that the property insurance bill Gov. Rick Scott signed has something in it that will make my homeowners' premium go up by 15 percent a year because of rising reinsurance costs. What the heck is this reinsurance, and why am I paying for it?

I read that the property insurance bill Gov. Rick Scott signed has something in it that will make my homeowners' premium go up by 15 percent a year because of rising reinsurance costs. What the heck is this reinsurance, and why am I paying for it?

We Say

Remaining fully informed about legislative changes to property insurance—and their impact—is a little like trying to follow the storyline in one of those too-cleverly written spy thrillers that keep you on edge. Keeping up with the twists and turns of annual legislative manipulation of property insurance law is hard enough for those of us in the business.

Our policyholders are even more confused, and not only feel on the edge of a cliff, but maybe over it. Help them back away by bringing context to inquiries over how the change in SB 408 related to reinsurance works.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.