NU Online News Service, June 22, 12:04 p.m. EST

Though property and casualty industry surplus is at records levels as of the end of the first quarter, insurers took a $4.5 billion underwriting loss, and recent developments point to worsening results in the second quarter.

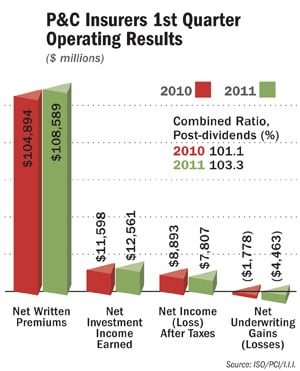

Underwriting losses outpaced a 3.5 percent increase to $108.6 billion in net written premiums, compared to the same period a year ago, according to a report of industry financial results distributed by ISO, the Insurance Information Institute, and the Property Casualty Insurers Association of America.

This is the first increase in first-quarter net premiums written since 2007 and the largest since 2004, says Michael R. Murray, assistant vice president of financial analysis for ISO.

However, the industry’s combined ratio climbed to 103.3 in the first quarter from 101.1 during the same quarter in 2010. First-quarter net income dropped to $7.8 billion from $8.9 billion.

However, the industry’s combined ratio climbed to 103.3 in the first quarter from 101.1 during the same quarter in 2010. First-quarter net income dropped to $7.8 billion from $8.9 billion.

“The deterioration in underwriting profitability as measured by the combined ratio is a particular cause for concern, because today’s low investment yields, together with the long-term decline in investment leverage that helped insulate insurers from the ravages of the financial crisis and the Great Recession, mean insurers need better underwriting results just be as profitable as they once were,” says David Sampson, president and CEO of PCI, in a statement.

The underwriting news could be worse when second quarter results are announced. ISO’s Property Claims Services unit says second-quarter catastrophes caused $14.7 billion in insured losses as of June 20 and losses from several other events need to be added to the amount, Murray adds. Additionally, the stock markets are down, which could mean capital losses on investments, he says.

“Yet these near-term negatives could have positive implications farther down the road to the extent that they erase some of insurers’ excess capacity and thereby hasten a turn in the insurance cycle,” Murray theorizes.

Industry surplus rose 1.4 percent to a record $7.8 billion at March 31. Sampson says insurers will have no trouble paying claims even if the hurricane season is as bad as predicted.

Add loss reserves and unearned premiums to surplus, and insurers had $1.3 trillion to pay claims, Sampson adds.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.