Despite years of ongoing efforts to identify and curb insurance fraud, it remains a significant problem. Conservative estimates from the Insurance Information Institute (I.I.I.) place the figure for annual P&C payouts on fraudulent or padded claims at more than $30 billion. A further disturbing statistic suggests that 10 percent of losses and loss adjustment expenses (LAE) are associated with fraud and abuse. Thus, a carrier with $100 million in direct written premium (DWP) and running at a 70-percent combined ratio is likely leaking more than $7 million annually because of fraudulent claim activities.

As the statistics indicate, fraud continues to be a profitable enterprise, with fraudsters often operating across vertical lines like P&C insurance, healthcare, and mortgages. Economic factors play an important role as well, with the down economy driving new entrants to practice fraud—both opportunistic (such as padding, waste, and abuse) as well as organized fraud schemes. Perhaps most noteworthy are the experienced fraudsters who continually revamp and innovate, developing entirely new schemes or improving old ones to avoid detection.

Economic factors play an important role as well, with the down economy driving new entrants to practice fraud—both opportunistic (such as padding, waste, and abuse) as well as organized fraud schemes. Perhaps most noteworthy are the experienced fraudsters who continually revamp and innovate, developing entirely new schemes or improving old ones to avoid detection.

Developing Corporate Culture

Fighting fraud effectively requires industry-wide collaboration. With the fine-tuned tactics that hardcore fraudsters employ to target their victims, no carrier can afford to lack a strong, unified strategy against fraud. Some collaboration already exists, as evidenced by an industry-wide claims database (ISO ClaimSearch®), numerous state fraud bureaus, and the National Insurance Crime Bureau (NICB). However, individual insurance carriers span the spectrum in terms of their capabilities to detect suspicious claims, their investment in investigative resources, and their corporate appetite to deny bogus claims and prosecute discovered fraud.

To enable more effective industry-wide collaboration, individual carriers must develop the right kind of corporate culture, create practical processes for handling suspicious claims, and implement systematic fraud detection solutions. Corporate culture is arguably the most important. Fighting fraud must be an enterprise-wide endeavor, with commitment beginning right at the top. Investigating suspicious claims cannot be a unilateral decision of the claims department because it also inevitably has implications for the legal department (in cases of disputes and suits); business areas (lost policyholders from incorrectly referred claims); and public relations (overcoming negative publicity such as blogging from dissatisfied claimants).

Organizational measurements must also be aligned to create the optimal environment for fighting fraud. Effective anti-fraud training is critical for the success of any fraud detection program, and much depends on the adjuster workflow for detecting and referring suspicious claims. The appropriate integration of process and technology is a must.

The third component of effective fraud-fighting is the development and use of solutions that can identify suspicious claims systematically. In the remainder of this article, let's focus on current and emerging analytical innovations that allow us to build more effective tools for systematic and semi-automated detection of suspicious claims.

Systematic Detection

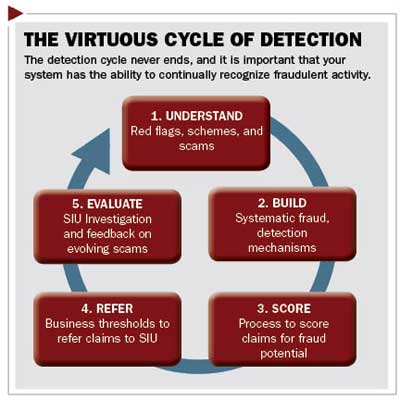

Building effective fraud-detection solutions requires a strong partnership between  business experts, such as investigators and adjusters, as well as analytical staff, including predictive modelers and data analysts. Given the ever-changing nature of fraud, this process is necessarily a virtuous cycle of continual development and improvement.

business experts, such as investigators and adjusters, as well as analytical staff, including predictive modelers and data analysts. Given the ever-changing nature of fraud, this process is necessarily a virtuous cycle of continual development and improvement.

Until recently, a simple special investigation unit (SIU) scorecard has been the tool for systematically detecting suspicious claims. Typically composed of expert-determined red flags such as indication that the accident was a set up, the claim was reported more than 20 days after loss, or there were unrelated claimants with same doctor, the scorecard has points, or weights, associated with each red flag. The adjusters determine which ones apply to the claim, total the associated points, and refer the claim to the SIU if the total exceeds a preset threshold.

While such scorecards serve a valuable business purpose, they can be further augmented with data-driven predictive modeling techniques. When presented with a historical body of claims, supervised techniques, such as regression models, decision trees, Naïve Bayes, and neural networks, and in some instances unsupervised techniques, such as clustering and outlier detection mechanisms, can produce effective models to determine suspicious claims. The features, or predictors, used in such models are often the expert-determined red flags, with their coefficients or weights being determined by the historical data and its correlation to the SIU action.

Beyond Structured Data

While conventional predictive modeling techniques can yield effective fraud-detection models, they only work with structured data such as code and value fields found in claims and policy databases. Date and time of loss, policy limits, insured driver age, claimant vehicle details, nature of injuries, and treatment duration are all examples of structured data. Often, valuable information that can identify suspicious claims may be buried in other data sources such as the adjuster's notes and claim networks.

Text mining is a recent application in extracting insights from claim notes. While claim notes pose special challenges such as typos, nonstandard abbreviations, grammatical issues, sentence fragments, and changing concepts over time, even simple and crude concept extraction can yield actionable insights. Text profiles can be created to look for adjuster descriptions of interesting concepts such as a low-impact accident¸ an accident near a highway exit, and when the claimant waives EMR/ambulance. An adjuster can use a structured field to denote the presence or absence of this concept in the notes section of each claim. Such structured fields can then be fruitfully leveraged by predictive modeling techniques.

Future Capabilities

Networks that relate claimants, attorneys, doctors, service providers, and other entities on a claim contain valuable information not easily accessible in a structured form. Given a particular person of interest, one can identify all claims associated with that person as well as all other entities associated with those claims. This querying can be applied  recursively to multiple degrees by then identifying claims and other entities associated with the entities discovered in the previous query. SIU personnel currently use interactive and deepening queries of this kind as a key capability in the identification and investigation of fraud rings.

recursively to multiple degrees by then identifying claims and other entities associated with the entities discovered in the previous query. SIU personnel currently use interactive and deepening queries of this kind as a key capability in the identification and investigation of fraud rings.

However, new capabilities are emerging to exploit claim networks in innovative ways.

Networks—and the participants therein—can be measured by characteristics such as density (number of entities or transactions to which a particular entity is connected) and betweenness (the extent to which an entity is directly connected only to those entities that are not directly connected otherwise), among others. A high density might be expected of a medical provider but not for a claimant in auto accidents. Calculating norms for these characteristics by type of entity can help flag abnormally deviant—and therefore interesting or suspicious—entities and behaviors. Tagging claims and entities with their network characteristics results in additional structured data that can be leveraged by the predictive modeling techniques mentioned earlier.

Emerging technical capabilities, including speech recognition, image and video analysis, telematics, and novel data sources, such as license plate readers, Facebook, and Twitter, will play a key role in creating structured data attributes that can significantly enhance fraud solutions in the future.

Facing the Challenge

Claim fraud continues to be a big business—and a big challenge. In addition to corporate culture, training, and process improvements, fighting fraud requires creating systematic and semi-automated tools to identify suspicious claims. Inventive applications of predictive modeling techniques in fraud detection have been growing with success. Text mining capabilities are expanding the scope of these solutions by discovering and integrating powerful insights from claim text. Growing advances in social network mining are unearthing and characterizing claim networks and participants. Because of the ever-changing nature of fraud, new technologies, capabilities, and data will continually need to be harvested, and innovations pursued, to produce better ammunition in the fight against fraud.

Karthik Balakrishnan, Ph.D., is vice president of analytics at ISO Innovative Analytics (IIA). IIA delivers advanced predictive analytics tools to the property/casualty insurance industry.

Thomas Mulvey is national director of claims and SIU solutions at ISO, an operating unit of Verisk Analytics.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.