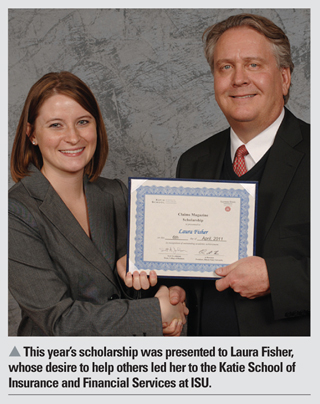

Each year, Claims Magazine awards an academic scholarship to a student at Illinois State University's (ISU) Katie School of Insurance and Financial Services. Through its undergraduate insurance and risk management and actuarial science programs, the school helps students get industry involvement early on. Claims Assistant Editor Catherine Couretas spoke with this year's scholarship recipient, Laura Fisher, whose desire to help others led her to the field.

Why did you decide to pursue a career in insurance?

When I first came to ISU, I actually applied as a social work major because I wanted a job where I would cultivate relationships with people. However, I also wanted to learn the business aspect. It ended up that I toured the Katie School and realized that I could help people through insurance.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.