One of four people in the southern U.S. incorrectly believes that flood damage from a hurricane is covered by homeowners' insurance, according to  recent research from the Insurance Information Institute. That is a serious gap in policyholder insurance knowledge that agents—especially in Florida—continually struggle against.

recent research from the Insurance Information Institute. That is a serious gap in policyholder insurance knowledge that agents—especially in Florida—continually struggle against.

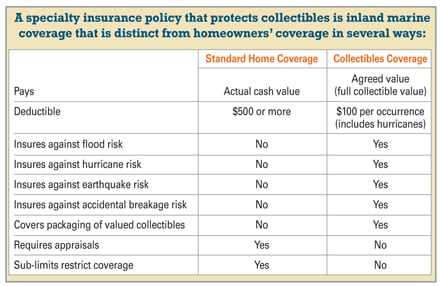

It is made worse by another common gap: Policyholders thinking that their valuable possessions such as collectibles are adequately covered by their homeowners' or renters' policy.

In reality, valued possessions are often inadequately insured by the contents' coverage of a homeowners' or renters' policy. For example, a homeowners' policy may have a $2,500 sub-limit (after deductible) for collections. The typical claims adjustment process would appraise these items at actual cash value. For a collector with a garage decorated as a vintage gas station or a dollhouse furnished over a 40-year period, a $2,500 check will underinsure the loss by thousands—maybe tens of thousands—of dollars.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.