NU Online News Service, May 17, 10:57 a.m. EDT

A third catastrophe risk modeling firm has weighed in on estimating insured losses from the late April tornado outbreak, putting a price tag of up to $6 billion on the insured damages.

A third catastrophe risk modeling firm has weighed in on estimating insured losses from the late April tornado outbreak, putting a price tag of up to $6 billion on the insured damages.

Newark, Calif.-based Risk Management Solutions (RMS) says its estimated range of $3.5 billion to $6 billion in insured losses from April 25-28 includes losses from personal, commercial, automobile and industrial lines.

The high end of RMS’s range represents the highest insured loss prediction of the three risk modelers, but each use a different date range to define the outbreak. AIR Worldwide estimated losses of up to $5.5 billion from April 22-28. EQECAT said losses could reach $5 billion from April 26-28.

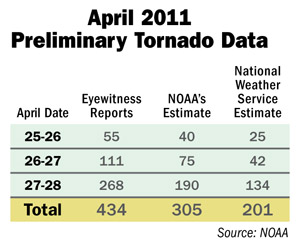

A large majority—about 70 percent—of the insured losses can be attributed to damages in Alabama, which experienced most of the severe weather during the April 25-28 tornado outbreak when 305 twisters touched down in the U.S. The National Oceanic and Atmospheric Administration says it was the largest tornado outbreak in history.

Three EF5 and 11 EF 4 tornadoes have been confirmed during the three-day outbreak, RMS reports. EF5 is the strongest ranking on the Enhanced Fujita scale, with winds of more than 200 mph.

About 40 percent of the estimated insured-loss range from RMS can be linked to a single tornado—an EF4 twister that swept by Greene, Jefferson and Tuscaloosa counties on April 27.

The historic outbreak from April 25-28 was not the only storm activity during the month. Earlier in April a violent weather system that included hundreds of tornadoes affected multiple states from Oklahoma to North Carolina, and a tornado hit the St. Louis metro area on April 22.

As of May 13, State Farm says it has received about 96,000 homeowners, renters, condominium and commercial insurance claims from storms April 14-29. The insurer has paid $175 million on these claims thus far, but both numbers will grow, “particularly the amount paid,” State Farm relays in an e-mail. An additional 37,000 auto claims have been filed, with about $40 million paid out. Similarly, both amounts are expected to grow, State Farm adds.

Columbus, Ohio-based State Auto Financial Corp. says it expects the April storms will cause between $75 million and $85 million in second quarter catastrophe losses, net of reinsurance recoveries. Five separate catastrophes in April affected 20 of the company's operating states, it says. More than 15,000 claims will be filed, State Auto estimates.

Allstate says it expects a $1.4 billion tab from the April storms. Liberty Mutual says storm activity in April is expected to cause $350 million to $450 million in losses, and Nationwide says its second-quarter operating income will be “challenged” by claims payouts from April.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.