Catastrophe-risk modeler EQECAT has dramatically changed its estimate of insured losses from the Tohoku, Japan earthquake to between $22 billion and $39 billion.

Shortly after the March 11 earthquake EQECAT released an insured-loss estimate of between $12 billion and $25 billion.

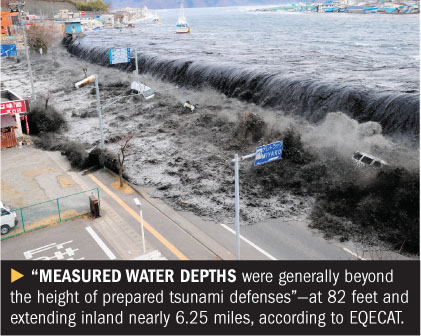

EQECAT says the upward shift in estimating losses is due to several factors. First, water depths from the tsunami that followed the earthquake were thought to be eight meters (26 feet), but the depths were more than 25 meters (82 feet) and extended inland about 10 kilometers (nearly 6.25 miles).

EQECAT says the upward shift in estimating losses is due to several factors. First, water depths from the tsunami that followed the earthquake were thought to be eight meters (26 feet), but the depths were more than 25 meters (82 feet) and extended inland about 10 kilometers (nearly 6.25 miles).

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.