NU Online News Service, May 10, 11:22 a.m. EDT

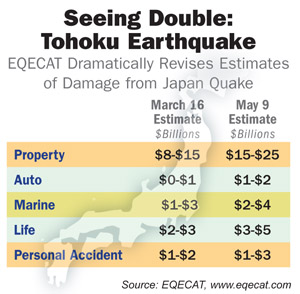

Catastrophe risk modeler EQECAT has dramatically changed its estimate of insured losses from the Tohoku, Japan earthquake to between $22 billion and $39 billion.

Catastrophe risk modeler EQECAT has dramatically changed its estimate of insured losses from the Tohoku, Japan earthquake to between $22 billion and $39 billion.

Shortly after the March 11 earthquake EQECAT released an insured-loss estimate of between $12 billion and $25 billion.

The adjustment comes after reinsurance brokerage firm Holborn says modelers were significantly underestimating market losses.

EQECAT says the upward shift in estimating losses is due to several factors. First, water depths from the tsunami that followed the earthquake were thought to be eight meters (26 feet), but the depths were more than 25 meters (82 feet) and extended inland about 10 kilometers (nearly 6.25 miles).

“Measured water depths were generally beyond the height of prepared tsunami defenses,” EQECAT says. “In many coastal areas even the tallest buildings were completely inundated with water. Damage to wood structures was virtually 100 percent—houses were completely removed from their foundations.”

About 28,000 people are dead or missing. More than 50,000 structures have been wiped out or severely damaged.

Losses were also adjusted due to a better understanding of damages caused by liquefaction, landslides, power outages, transportation interruption and disruption at the nuclear power plant in Fukushima.

More News & Analysis on the Japanese Earthquake and Tsunami

Property insurers will bear a large portion of losses. Revised property loss estimates resemble EQECAT’s original prediction for losses to the entire market—between $15 billion and $25 billion. Of this amount, $7 billion to $12 billion is attributed to Japan’s unregulated cooperative insurance companies, collectively known as Kyosai. Kyosai does not cede losses to the government’s Japan Earthquake Reinsurance Pool (JER) like the general non-life companies do. Losses to the general non-life companies are estimated to be in the range of $3 billion to $5 billion, EQECAT says.

The non-life commercial insurers, which rarely cover business interruption, are expected to pay out between $5 billion to $8 billion, the modeler adds.

EQECAT’s overall loss estimate also includes marine, auto, life and personal accident lines of coverage, as well as demand surge. The estimate does not include loss-adjustment expenses, contingent business interruption, or losses related to the current emergency at power plants.

Though the Fukushima plant suffered the most damage and release of radioactivity, 13 nuclear reactors at three power plants are now out of operation, EQECAT reports.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.