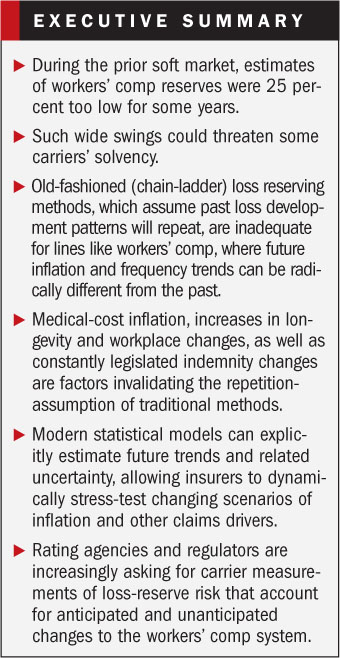

Sudden natural disasters such as the tragic Tohoku earthquake in March are not the only catastrophes that can impact insurers' balance sheets and policyholder surplus. Such well-publicized natural catastrophes only account for about 7 percent of insurers' notable capital and surplus impairments triggering regulatory action and concern.

Of the remaining 93 percent, by far the largest cause of impairments over the past 30 years emanated from inadequate pricing and deficient loss reserves—resulting in approximately 40 percent of the cases, according to a May 2011 study (“A.M. Best Special Report: 1969-2010 Impairment Review”).

Of the remaining 93 percent, by far the largest cause of impairments over the past 30 years emanated from inadequate pricing and deficient loss reserves—resulting in approximately 40 percent of the cases, according to a May 2011 study (“A.M. Best Special Report: 1969-2010 Impairment Review”).

Loss-reserve uncertainty is arguably one of the most difficult risks on an insurer's balance sheet to estimate and monitor. The workers' compensation line of business represents the largest portion of the U.S. property and casualty industry's net reserves, contributing nearly a quarter of total current net-loss and adjustment-expense reserves.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.