Insurance-industry experts are cautioning that the death of Osama bin Laden does not represent the end of the terrorism threat for the United States. The threat, in fact, may worsen if terrorists seek to execute a reprisal attack.

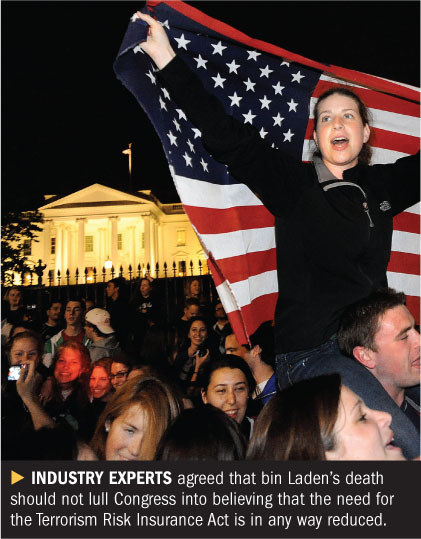

And while there was some difference of opinion among experts about what bin Laden's death means for the terrorism-insurance market, all agreed that the event should not lull Congress into believing that the need for the Terrorism Risk Insurance Act (TRIA) is in any way reduced.

And while there was some difference of opinion among experts about what bin Laden's death means for the terrorism-insurance market, all agreed that the event should not lull Congress into believing that the need for the Terrorism Risk Insurance Act (TRIA) is in any way reduced.

President Obama announced last week that the much-sought-after leader of Al Qaeda was killed in a military operation in Pakistan, where U.S. intelligence had tracked him down in a sprawling compound in Abbottabad.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.