NU Online News Service, May 4, 12:57 p.m. EDT

Reinsurance brokerage firm Holborn says estimates of insured losses from the Tohoku, Japan earthquake and tsunami in March are off by as much as $23 billion.

Reinsurance brokerage firm Holborn says estimates of insured losses from the Tohoku, Japan earthquake and tsunami in March are off by as much as $23 billion.

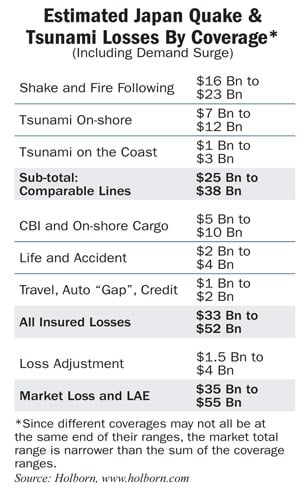

Holborn puts insurance market losses at between $35 billion and $55 billion after adding coverages not included in predictions given by the three catastrophe risk modeling firms: EQECAT, AIR Worldwide and Risk Management Solutions.

The estimates from the modelers include different kinds of coverage, Holborn points out in a report. For instance, RMS’s estimate is for nearly all insured losses while EQECAT excludes contingent business interruption (CBI) and AIR leaves out demand surge, auto and others. Each excludes loss adjustment expenses (LAE).

Holborn says its “adjusted range” from modelers is $19 billion to $32 billion. To develop this adjusted range, Holborn says it “adjusted [modelers’] estimates to a common basis, excluding life but including marine and auto lines,” and left out CBI and onshore cargo.

Holborn’s loss-estimate range, meanwhile, includes LAE, earthquake, tsunami, demand surge, CBI and cargo, and life coverages.

Life and accident expected losses drove the estimate up by between $2 billion and $4 billion

The inclusion of CBI and cargo had a more significant impact. This line was misinterpreted by the modelers in coming up with their estimates, Holborn says.

“The modeling companies have analyzed the policies provided by Japanese companies and reflected that coverage is limited and often does not include earthquake,” the reports reads. “But their analysis appears to not consider the coverages U.S. and European insurers give for their insureds’ indirect Japanese exposures.”

Holborn notes that General Motors has already filed a $1 billion CBI claim for plant exposures in the U.S. Using this as a guide, Holborn puts losses related to CBI and cargo at $5 billion to $10 billion.

Additionally, Holborn says reinsurers could have as much as a $25 billion gross loss, which would match losses from Hurricane Katrina and 9/11.

“Reinsurers have fewer resources after this event (both capital and retrocessional protections) than they did before,” Holborn says. “Another event later in the year would cause significant stress.”

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.