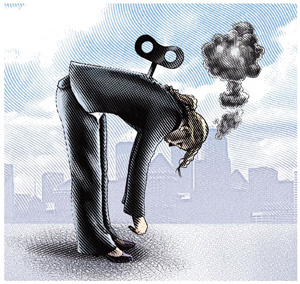

Dolly Parton may have popularized the song, “9 to 5,” but sooner or later, adjusters realize their jobs do not conform to that time span. A claims  adjuster's work is never really done. There is always another file, one more case assignment, and one more investigative task to complete. Adjusters are knowledge workers; they don't always leave their jobs when they leave the office.

adjuster's work is never really done. There is always another file, one more case assignment, and one more investigative task to complete. Adjusters are knowledge workers; they don't always leave their jobs when they leave the office.

West coast clients want conference calls at 8 p.m. to discuss a claim. Policyholders, claimants, or key witnesses often can only meet with adjusters after 7 p.m. At 3:30 a.m., the phone rings, summoning the snoozing adjuster to the scene of a tractor trailer cargo overturn. The 8-hour work day is as common as the three-martini lunch.

Historically, courts have viewed adjusters as professional employees and thus ineligible for overtime pay. Instead, overtime pay was for those in support roles: hourly workers like receptionists, file clerks, or mailroom attendants. An adjuster “privilege” was to be ineligible for overtime pay. Even if you worked 70 hours that week, then you earned the same amount as if you had logged 40 hours. A trade-off for being considered “professional” is that, typically, professionals do not receive overtime pay. They work as long as needed to accomplish the job.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.