In the last three years, Calif. has seen a 9-percent increase in the number of questionable claims (QCs) reported, according to the National  Insurance Crime Bureau (NICB). Dominated by questionable vehicle thefts and faked/exaggerated injuries, these QCs are referred to the NICB by the more than 1,100 member insurance companies and require at least one (and as many as seven) indicators of possible fraud.

Insurance Crime Bureau (NICB). Dominated by questionable vehicle thefts and faked/exaggerated injuries, these QCs are referred to the NICB by the more than 1,100 member insurance companies and require at least one (and as many as seven) indicators of possible fraud.

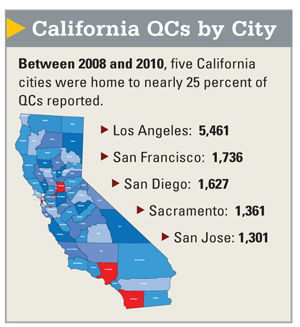

The claims in Calif. made up nearly 50,000 of the 250,350 QCs across the country between 2008 and 2010, though were few in comparison to the 235,000 claims reports that are submitted to ISO daily.

When it came to policy type for California QCs, the most common (54 percent) was personal automobile, with other common policy types being personal property, workers' compensation and employer's liability, and commercial automobile.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.