They Say, Hearsay I resent paying an insurance premium, so my defense is to pay off the house. Then, I will pay myself the $2,000 a year that I now fork over to the insurance company. Odds are that in the next 25 years, I will come out ahead.

I resent paying an insurance premium, so my defense is to pay off the house. Then, I will pay myself the $2,000 a year that I now fork over to the insurance company. Odds are that in the next 25 years, I will come out ahead.

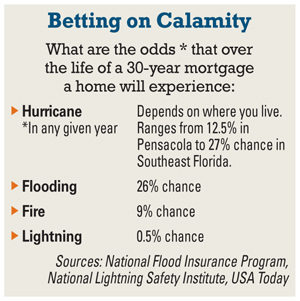

We SayBeing able to pay off a mortgage is for the prosperous, smart, and lucky. Deciding to self-insure kind of eliminates the smart people from the mix, though the prosperous and lucky might remain—for a while at least. There are those who will take a gamble on 25 years without a major hurricane in Florida. Hey, only 20 more years to go, since we've been storm-free for five years in a row already. What are the odds that a storm will strike this year or next?

Actually, the odds are that a Category 3 storm or greater will strike Florida every four years, on average. Another fact for everyone—the gamblers and the more rational among us—to consider: The entire sum of money paid for property insurance over the life of a typical 30-year mortgage is a surprisingly small fraction of a home's replacement value and the value of its contents, usually between 10 and 14 percent. That does not even factor in the benefit for additional living expenses if the homeowner is displaced because of damage.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.