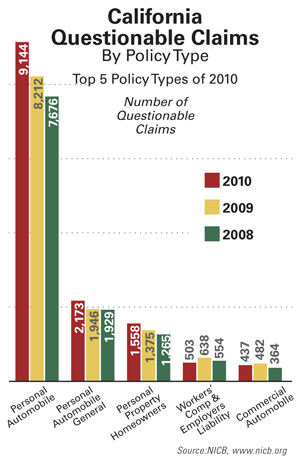

In the last three years, Calif. has seen a 9-percent increase in the number of questionable claims (QCs) reported, according to the National Insurance Crime Bureau (NICB).

In the last three years, Calif. has seen a 9-percent increase in the number of questionable claims (QCs) reported, according to the National Insurance Crime Bureau (NICB).

Dominated by questionable vehicle thefts and faked/exaggerated injuries, these QCs are referred to the NICB by the more than 1,100 member insurance companies and require at least one (and as many as seven) indicators of possible fraud.

"California sees the most, by far, vehicle thefts per year," said Frank Scafidi, director of public affairs for NICB. "Many of these are what we call 'owner give-ups;' thefts reported to police by owners who actually had a role in the vehicle's disappearance."

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.