NU Online News Service, April 6, 12:03 p.m. EDT

Georgia Insurance Commissioner Ralph T. Hudgens says deadly storms that struck the state this week have caused insured losses of about $50 million.

Georgia Insurance Commissioner Ralph T. Hudgens says deadly storms that struck the state this week have caused insured losses of about $50 million.

The commissioner toured Jonesboro, Ga., yesterday to inspect damaged areas. The estimate includes damage to vehicles, homes and business, he says.

State Farm spokesman Justin Tomczak says strong straight-line winds and some hail throughout the state have generated more than 1,800 claims.

“There is no one central affected area,” Tomczak says. “The damage is scattered everywhere.”

Claims have also been filed due to fire started by lightning strikes, Tomczak reports.

The National Weather Service (NWS) says the storm system produced strong, gusty winds, heavy rain, pea- to baseball-sized hail and one tornado. Georgia was not the only state affected, as damage reports have come from states throughout the Southeast.

The NWS has confirmed that a tornado carrying winds of 130 mph touched down in Eastman, Ga., killing one.

Downed trees fell on top of houses and vehicles, reports the NWS. Fallen trees reportedly killed six people. Other deaths have been reported in Mississippi and Tennessee.

This was the second line of severe storms in Georgia in just over a week, says Tomczak. State Farm received more than 1,000 hail and wind-related claims from storms during the last weekend in March and sent additional resources, including its Catastrophe Response Vehicle, to the state to help with claims volume.

“State Farm claim representatives are already on the ground throughout the state, inspecting damage, assisting agents and taking care of policyholders,” says Tomczak.

Victims of the storm are encouraged to make temporary repairs to prevent further damage, and to save their receipts, he adds.

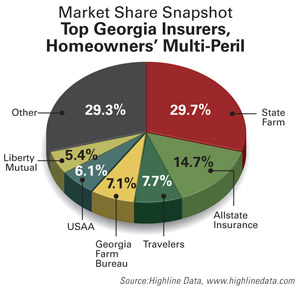

According to Highline Data, the top writers of homeowners insurance in 2010 were State Farm (29.7 percent market share), Allstate Insurance (14.7 percent), Travelers (7.7 percent), Georgia Farm Bureau (7.1 percent) and USAA (6.1 percent).

Highline Data is a part of Summit Business Media, which also owns National Underwriter.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.