They Say, Hearsay

I'm reading that insurance fraud is driving up my auto insurance rates, with faked car crashes and the like. Well, I've never had an auto accident, so where does the insurance industry come off by passing those costs on to me? Why don't they go after the fraudsters and leave me out of it?

I'm reading that insurance fraud is driving up my auto insurance rates, with faked car crashes and the like. Well, I've never had an auto accident, so where does the insurance industry come off by passing those costs on to me? Why don't they go after the fraudsters and leave me out of it?

We Say

Floridians are learning about the "fraud tax" they pay related to auto insurance fraud, and they want that tax axed. So do insurers, and they are working with law enforcement and the Florida Division of Insurance Fraud (DIF) to put insurance scammers out of business as quickly as possible. As of mid-March, DIF has arrested 109 people for fraud related to Personal Injury Protection (PIP), and the state's Chief Financial Officer Jeff Atwater has put fraud fighting on the front burner. That's not the only thing turning up the heat. It is likely that there will be something done on the legislative level to make PIP fraud fizzle.

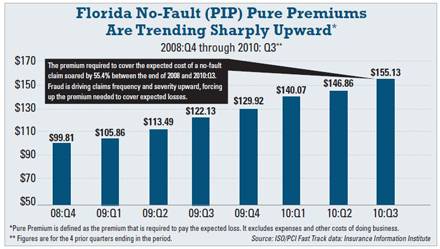

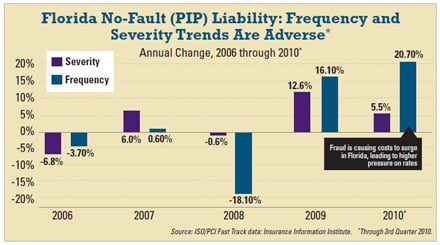

There are a lot of numbers circulating about what fraud adds to Floridians' auto insurance bill. Here's a number that drives home the impact: The average driver's fraud tax in 2010 was about $49 per vehicle. Absent any measures to put the brakes on the trend, the fraud tax could rise to nearly $84 this year. This means the typical two-car family paid nearly $100 more for auto insurance last year to support Florida's runaway insurance fraud industry and could be paying nearly $170 this year. Multiply those figures by the 11.28 million insured vehicles on the roadways and you're looking at the PIP pot of money that fraud scammers are hoping to pocket. No-fault fraud already cost Florida drivers and their insurers an estimated $853 million since 2008. The total could rise to $1.5 billion if left unchecked. The Insurance Information Institute (I.I.I.) calculated the fraud tax based on the differences between the actual and expected difference in no-fault pure premium. Pure premium does not account for operating  costs or the costs of investigating or prosecuting fraud. The calculation was also based on the expectation that annual costs rise by the same rate as the medical component of the Consumer Price Index, which was 3.2 percent in 2009 and 3.4 percent in 2010. The base year for the I.I.I. analysis was 2008, when pure premium was $98.81 in Florida. We did the math and discovered that the premium required to cover the expected cost of a no-fault claim soared by 55.4 percent between the end of 2008 and the third quarter of 2010.

costs or the costs of investigating or prosecuting fraud. The calculation was also based on the expectation that annual costs rise by the same rate as the medical component of the Consumer Price Index, which was 3.2 percent in 2009 and 3.4 percent in 2010. The base year for the I.I.I. analysis was 2008, when pure premium was $98.81 in Florida. We did the math and discovered that the premium required to cover the expected cost of a no-fault claim soared by 55.4 percent between the end of 2008 and the third quarter of 2010.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.