Louisiana Insurance Commissioner Jim Donelon has rejected State Farm's request for a statewide 14.3 percent homeowners rate hike and approved a reduced rate increase for Louisiana Citizens Insurance Corp., the state's last resort insurer.

State Farm spokeswoman Molly Quirk says the company is still in talks with the Louisiana Insurance Dept. in order to make its case for the requested rate increase, which was filed in order to "move toward rate adequacy."

The conversations include the company's use of catastrophe models in calculating rates. Quirk says State Farm uses hurricane models from all three modelers (Risk Management Solutions, AIR Worlwide and EQECAT).

Last year Donelon rejected a 19.1 percent rate increase for State Farm. He later approved a 9.9 percent rate increase.

Last year Donelon rejected a 19.1 percent rate increase for State Farm. He later approved a 9.9 percent rate increase.

When denying the rate request early last year, Donelon said he had concerns about State Farm's use of the EQECAT model, which projected hurricane losses 150 percent higher than losses produced by the two other industry hurricane models.

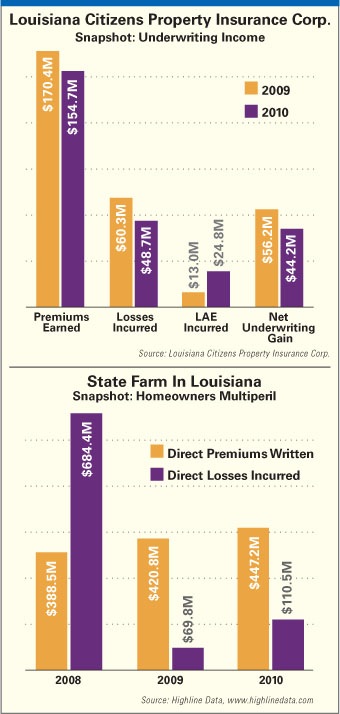

Louisiana Citizens Insurance Corp., which has about 115,000 property insurance policies in the state, had originally asked for a 9 percent rate hike. It is obligated to make a rate filing once a year.

The residual insurer accepted a reduced 6.5 percent rate hike, Donelon tells NU.

Louisiana Citizens comes up with its filings by comparing market rates and its own actuarial insurance rates in each parish, adding 10 percent, and then selecting whichever rate is the highest.

Last year, John Wortman retired as CEO of Louisiana Citizens, and Richard Robertson, general manager of the Michigan Basic Property Insurance Association (Michigan FAIR Plan), took over.

According to Highline Data, Louisiana Citizens was the third-largest homeowners multiperil writer in the state as of 2009 with a 6.4 percent market share. State Farm was first with 27.9 percent, and Allstate was second with 14 percent.

Highline Data is a part of Summit Business Media, which also owns National Underwriter.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.