NU Online News Service, March 21, 10:36 a.m. EDT

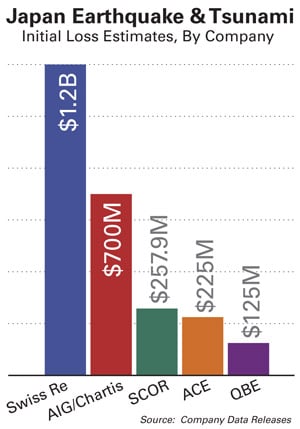

Swiss Re said it expects $1.2 billion in claims from the Japan earthquake and tsunami on March 11, and warned that the estimate is subject to a high degree of uncertainty.

Swiss Re said it expects $1.2 billion in claims from the Japan earthquake and tsunami on March 11, and warned that the estimate is subject to a high degree of uncertainty.

The estimate is pre-tax and net of retrocession, and is mostly based on modeled estimates.

The Zurich-based reinsurer added that the incident at the Fukushima nuclear power plant is “unlikely to result in significant direct loss for the property and casualty insurance industry.” Coverage for physical damage and liability for nuclear facilities excludes earthquake, and fire and tsunami following a quake.

Insurance for commercial and industrial earthquake, fire and tsunami risks is sold in the private market in Japan and is commonly reinsured, Swiss Re explained. Property policies exclude nuclear contamination.

Late Friday, American International Group Inc. (AIG) released a pre-tax loss estimate for first-quarter catastrophes of $1 billion for Chartis, its P&C unit. The total includes a pre-tax insurance loss of $700 million related to the Japan earthquake.

AIG said the estimate does not include losses from AIG’s operations that participate in the Japan Earthquake Reinsurance Company. AIG holds a 54.66 percent equity stake with Fuji Fire and Marine Insurance Company Ltd.

AIG general operations in Japan had catastrophe reserves of about $500 million for earthquake damage claims, which will be used to pay the claims and reduce the impact on the liquidity of these operations.

Companies cannot establish catastrophe reserves in the U.S., according to generally accepted accounting principles (GAAP), AIG pointed out. Therefore, the maximum GAAP loss AIG companies in Japan would incur from residential earthquake damage is about $575 million pre-tax.

Swiss Re said that attuning its loss estimate to that of ceding clients’ estimates and original policyholder losses “will take an extended period of time.”

“The high proportion of commercial and industrial claims in the reinsured share of this event will extend the evaluation process,” Swiss Re said in a statement. The company said it remains “fully committed” to the Japanese market.

Residential earthquake risk is not reinsured in the international reinsurance market. Through an optional endorsement to a fire policy, earthquake coverage is available from nonlife companies in Japan. All risks from the regulated market are retained by the Japan government and reinsured by the Japan Earthquake Reinsurance Company.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.