NU Online News Service, March 15, 11:01 a.m. EST

Merger and acquisition activity for property and casualty insurers, agents, and brokers heated up in 2010 as insurers sought to improve their strategic standing within the industry, according to a report from Conning Research & Consulting.

Merger and acquisition activity for property and casualty insurers, agents, and brokers heated up in 2010 as insurers sought to improve their strategic standing within the industry, according to a report from Conning Research & Consulting.

The Conning report, “Global Insurance Mergers & Acquisitions in 2010, Moving From Defense to Offense,” said global insurance M&A activity picked up steam in 2010 as improved valuations and the continued soft market, now in its seventh year, increased the activity in the United States.

“M&A was a direct response to the challenge of growth in a soft market,” the report said.

Eager to grow, but realizing how difficult that is in a market downturn, M&A transactions proceeded with caution for fear they would not produce the “desired result.”

“Buyers looked long and hard at many prospects before inking a deal,” the report said.

In 2010 there were 721 transactions at a reported value of more than $79 billion. By comparison, in 2009 there were 601 transactions at a reported value of $52 billion.

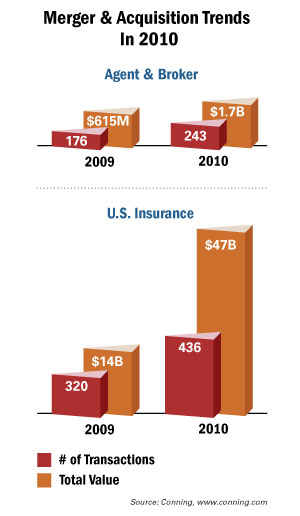

In the U.S. alone, there were 436 transactions with a total value of less than $47 billion, compared to 320 transactions valued at more than $14 billion in 2009. That translates into an increase of 36 percent in the number of transactions.

Conning said the principal drivers for this activity were a “more vibrant economy, more buoyant equity markets, stronger capital positions at insurers, soft market insurance conditions, and the release of pent-up demand to pursue acquisitions after low 2009 levels.”

Deals were fueled by increased valuations in companies that encouraged many stock-for-stock deals, the report said.

One of the consequences of the soft market is higher combined ratio as underwriting does not adequately cover the cost of claims. To combat this, some carriers seek out specialty insurers with “more attractive margins” in an effort to improve their overall combined ratio, the report noted.

The report notes that few U.S. insurers pursued acquisitions outside of the U.S. Globally, those insurers that did pursue foreign acquisitions turned to Asia and Latin America, considered fast-growing emerging markets.

Among agents and brokers in the U.S., the number of announced transactions rose 38 percent from 176 in 2009 to 243 in 2010. The value of these transactions jumped from $615 million in 2009 to $1.7 billion in 2010.

The report notes that the value for some of the largest transactions during the year were not announced, such as AmWINS acquisition of Colemont and Swett & Crawford's merger with Cooper Gay.

The major acquirers in 2010 were Brown & Brown, Arthur J. Gallagher, Hub, and Marsh & McLennan Agencies.

While private equity firms and brokers backed by private equity were more active, banks decreased their involvement in the insurance space, with many shedding operations, the report said. The same was true outside of the U.S., Conning noted.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.