Bermuda-based insurers and reinsurers all face similar challenges in 2011, but as executives of these firms discussed their results for 2010, they each mapped out unique approaches for moving ahead.

Even though last year's underwriting profits for all 17 Bermuda firms regularly tracked by NU moved in a single direction—down from 2009, with the average combined ratio deteriorating 8.9 points—only four reported top-line premium declines. Each of the others had a different story to explain stable or slightly rising 2010 premium volumes—and strategies for growth in 2011.

Even though last year's underwriting profits for all 17 Bermuda firms regularly tracked by NU moved in a single direction—down from 2009, with the average combined ratio deteriorating 8.9 points—only four reported top-line premium declines. Each of the others had a different story to explain stable or slightly rising 2010 premium volumes—and strategies for growth in 2011.

Innovative, one-off, multiyear deals and longer-term new business initiatives highlighted earnings conference calls otherwise marked by discussions of continuing soft-market conditions and a nearly unprecedented number of non-U.S. catastrophe events. In total, the 17 groups incurred $3.5 billion in losses from the Chilean earthquake, Deepwater Horizon, a September earthquake in New Zealand and December flooding in Australia.

(A special NU analysis of catastrophe losses for the group and prior-year loss reserve takedowns, which softened the cat impacts, is available on our website. Search keywords: “Data Dive Bermuda.”)

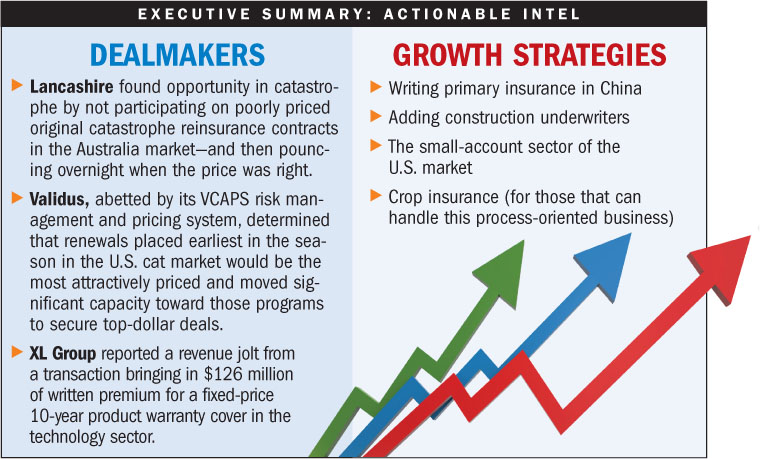

But even catastrophes bring opportunity, according to Richard Brindle, CEO of Lancashire Insurance, who described during a year-end earnings conference call his firm's recent efforts to provide backup reinsurance coverage for insurers whose programs were depleted by the Australian and New Zealand events.

He noted that Lancashire, which writes energy, marine, aviation and terrorism insurance as well as a book of property reinsurance, did not participate on poorly priced original catastrophe reinsurance contracts for these cedents. “We have always felt Australasian cat business is incredibly cheap. You have so many different types of natural catastrophes, and they happen pretty much annually,” he said.

In December and January, insurers came to market to buy backups to the original cat programs they had taken out at July 1, 2010. They had essentially burned their first layer of coverage, and their reinstatement and possibly their second reinstatement, Mr. Brindle reported. He noted that Lancashire also declined to participate in that “first round of backups” because those deals were still based on the original pricing.

Subsequently, after more floods occurred in early February, the Australian regulator started asking companies to demonstrate that “they had at least two tranches of cover in place from that time forward” until the June 30 expiration date of the original reinsurance contracts, Mr. Brindle said.

In one case, brokers arranged hundreds of millions in cover overnight, he reported. “We led the way on price with a couple of other companies. I don't wish to sound like I'm gloating, but we pushed it to very good pricing levels,” he said.

“We were able to turn it all around in about 24 hours. It was a good vindication of the way we trade,” Mr. Brindle said, referring to Lancashire's flat structure and ability to get him together with Lancashire's chief financial officer Elaine Whelan, as well as the chief actuary, the chief risk officer and the underwriters, “to bear down on this type of opportunity when it presents itself.”

Validus CEO Edward Noonan reported a similarly rapid turnaround on a late-December deal without revealing many specifics of U.S. cover for a major international carrier but suggesting that an internal analytical tool was key to the successful placement.

Using a capital-allocation risk management and pricing system known as VCAPS, “our underwriters and risk-management team were able to extract street-level risk data from our data warehouse,” simulate the effect of modeled exposures on Validus' existing portfolio “and put a binding quote together in less than an hour,” Mr. Noonan reported.

While competitors offered cheaper coverage, “Validus wrote the entire deal on the basis of creativity and responsiveness,” he said, adding that the company has turned down requests from other insurers and reinsurers to license the proprietary model.

He also told analysts that his firm generally shrank its international catastrophe book at Jan. 1 because of excessive pricing competition in Europe and Australasia, while nimbly finding well-priced deals in the U.S. cat market even though rates there generally fell 7.5 percent.

“We concluded that renewals placed earliest in the season would be the most attractively priced [and] moved significant capacity toward those programs,” he said. In addition, he said Validus' ability to offer significant capacity to large global clients enabled the reinsurer “to write a number of private transactions outside of market placements” with better terms.

Like the two “Class of 2005” companies formed in the wake of Hurricane Katrina, Validus and Lancashire, one of the oldest Bermuda companies, XL Group, reported a revenue jolt from a single transaction—this time an insurance deal bringing in $126 million of written premium for a fixed-price 10-year product-warranty cover in the technology sector, according to CEO Michael McGavick and David Duclos, executive vice president and chief of insurance operations.

Mr. Duclos said the deal came about because of the carrier's “willingness to be innovative in terms of crafting coverage.” Responding to an analyst worried about the lack of price flexibility over the 10-year term of the deal, however, he responded that the account represented “a specific opportunity…to apply [XL's] innovation” rather than “a standard approach” to putting long-term agreements into the market.

LONG-TERM PLANS

Supplementing unique one-off deals, Bermuda executives described an array of longer-term strategic growth initiatives. Mr. McGavick, for example, listed the receipt of a license to write primary insurance in China and the launch of an “Office of Strategic Growth” officially charged with planning growth and enhancing existing efficiencies.

“We keep talking about waiting for the [market] turn and all of that, but in the end we have to operate our businesses as if these are conditions in perpetuity,” he said, explaining the new office. “We have to fight the notion there is nothing we can do. There are pockets of appropriate returns,” he said.

Pointing to one, he said XL added experienced North American construction and surety underwriters to an existing team in response to forecasted construction spending and U.S. government intentions. “We see a lot of opportunity to be a meaningful player in something that…will be more and more important over time.”

Endurance Specialty Holdings is eyeing opportunity in the small-account sector of the U.S. insurance market, according to CEO David Cash. “Large insurance risks continue to attract undue competition,” he said. In addition, while there is a “greater degree of underwriting restraint” among reinsurers, even in that market “there are a number of places where competition is almost certainly too fierce to produce an appropriate return.”

Endurance joined the likes of Montpelier, a fellow member of the “Class of 2001”—the class formed in the wake of the 9/11 attacks—when it launched a new U.S. Contract Binding Authority Unit to operate within Endurance American Specialty Insurance Co., its U.S. surplus-lines insurer, last November. The unit targets low-premium accounts of around $3,000-$4,000, Mr. Cash said.

He also said Endurance continues to be bullish on the crop market, which it entered back in 2007 with the acquisition of ARMTech, a managing general agent specializing in underwriting U.S. federally sponsored crop insurance.

In contrast, RenaissanceRe sold off its crop and U.S. specialty-insurance businesses to QBE in a deal announced late last year. Asked about the transformation during an earnings conference call in early February, CEO Neill Currie said the crop business is becoming a more process-oriented one that demands greater size. “We always [try] to be pretty lean and nimble,” he said.

(In an interview with NU this month, Mr. Currie explained RenRe's exit from the specialty program insurance segment, as well. See page 22.)

Meanwhile, Everest Re CEO Joseph Taranto told analysts last month that after a poor 2010 for his firm's insurance business, Everest's January acquisition of Heartland Crop Insurance, a Topeka, Kan.-based MGA, will be part of “a significant transformation,” expanding its presence in short-tail specialty insurance lines.

Everest will also shed longer-tail general liability programs. “This sector will be much smaller for us in 2011 as we phase our C.V. Starr business from our paper to Starr's paper,” he said, noting that in 2011 Everest will continue to support Starr as a reinsurer.

See Related Chart: 2010 Financial Results For Selected Bermuda Insurers

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.