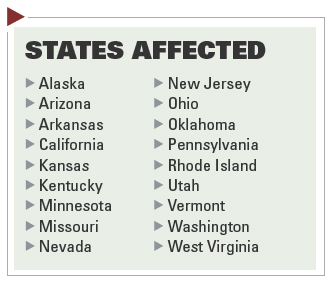

The following provides a brief overview of cases from 18 jurisdictions affecting important areas of insurance claim handling for 2010. In order to locate these cases, we performed searches online through Westlaw. Searches were conducted to include all 50 states for the year. Search topics included statute of limitations, damages, and coverage. Our case selection criteria hinged on two factors: where the case holding highlighted a change in the precedent or law; the second where the case holding reinforced a current precedent or law.

The following provides a brief overview of cases from 18 jurisdictions affecting important areas of insurance claim handling for 2010. In order to locate these cases, we performed searches online through Westlaw. Searches were conducted to include all 50 states for the year. Search topics included statute of limitations, damages, and coverage. Our case selection criteria hinged on two factors: where the case holding highlighted a change in the precedent or law; the second where the case holding reinforced a current precedent or law.

Medicaid Lien Recovery

- Florida – Scharba v. Evrett, 2010 WL 1380121 (March 31). Because the Medicaid lien does not exceed 50 percent of the amount recovered in the settlement, the Florida Agency for Health Care Administration is entitled to recover the full amount of the lien.

Expert Testimony

- Delaware – Hudson v. Old Guard Ins. Co., 3 A. 3d 246 (September 1). Reaffirms that there is a limit to the knowledge about which an expert can testify. An expert cannot testify about a subject that falls within the purview of a layperson's knowledge.

- Connecticut – Utica Mut. Ins. Co. v. Precision Mechanical Services, Inc., 998 A. 2d 1228 (July 13). Also reaffirms that there is a limit to the knowledge about which an expert can testify. An expert cannot testify about a subject when a jury would have common knowledge.

Punitive Damages

- North Dakota – McElgunn v. CUNA Mut. Ins. Society, 700 F. Supp. 2d. 1141 (March 22). Holding $6 million in a punitive damages award against the insurer for breach of contract and bad faith, which was greater than compensatory damages award by ratio of 30:1 exceeded due process limits and was reduced to ration of 8:1, or $1.6 million.

- Ohio – Neal-Pettit v. Lahman, et al, 928 N.E.2d 421 (May 4). Public policy prevents insurance contracts from insuring against claims for punitive damages based upon an insured's malicious conduct. However, attorney fees awarded as a result of punitive damages in automobile negligence action could fall under the general coverage of defendant's insurance policy for “damages [that] an insured person is legally obligated to pay” because of “bodily injury.”

- West Virginia – Camden-Clark Memorial Hospital Corp. v. St. Paul Fire and Marine Insurance Co., (June 7). The federal court applied two principles certified by the state upreme court in 2009, which were:

- Where insurer has no duty to defend and the insured has controlled the defense, the insured has the burden of proof to establish proper allocation of the jury verdict between covered and not covered; and

- Where the insurance policy does not exclude punitive damages and there is no duty to defend, an insured who has controlled the defense in a case resulting in a punitive damage award and who seeks allocation of the award has the burden of proving that the claims on which the punitive damage award is based is covered by the terms of the policy.

- District of Columbia – Nkpado v. Standard Fire Insurance Co., 697 F.Supp. 94 (March 24). Insured who engaged in negotiations with insurer past the one-year contractual deadline for filing suit on the policy is time-barred. Punitive damages can only be awarded where the alleged breach merges with and assumes the character of a willful tort.

Uninsured Motorist – Phantom Vehicle

- Wisconsin - Zarder v. Humana Ins. Co. 782 N.W. 2d. 682 (May 14). Holding that where a vehicle that struck insured minor bicycle rider and left the scene without the driver providing identifying information was a hit-and-run vehicle under terms of policy and thus policy provided coverage.

Statute of Limitations

- Oregon - Snyder v. Espino-Brown, 230 P.3d 122 (April 28). Insurer for defendant made advance payment for property damage to plaintiff's husband, a joint owner of the vehicle, without giving notice of the date upon which the statute of limitations would run as required by statute. Therefore, the statute was tolled and plaintiff's case was not time-barred.

This case can provide guidance for 18 other states, all of whom have similar requirements in their Unfair Claims Settlement Practices Acts and/or regulations. This case demonstrates the effect of the failure to advise an unrepresented claimant of the deadline imposed by the statute of limitations.

- Nebraska - Perez v. Stein, 777 N.W.2d 545 (January 15). The personal representative's sole task in a wrongful death action is to distribute any recovery to the beneficiaries. Therefore, the statute of limitations on a legal malpractice action by the children is tolled by their minority even though mother/personal representative's malpractice action for her damages is time-barred.

Commercial General Liability Coverage

- Indiana – Sheehan Construction Co., Inc. v. Continental Cas. Co., 2010 WL 3823107 (September 30). Contractor's commercial general liability (CGL) policies could provide coverage for subcontractors' faulty workmanship. The contractor would then be liable for costs to repair water damage.

Unfair Claim Settlement Practices

- Kentucky – Shaheen v. Progressive Casualty Insurance Co., 2010 WL 561601 (February 10). The Kentucky Uniform Claims Settlement Practices Act and Kentucky appellate opinions require an insurance company to deal in good faith with a claimant, whether the claimant is an insured or a third party. While the insurer is obligated to obtain a full release of its insured, Kentucky does not believe that an insurer cannot logically owe a duty of good faith and fair dealing to the insured and a fiduciary duty to an adversarial third party in the same matter. Kentucky law does not state that the insurer's duty to its insured must be favored over its duties to the claimant.

Bad Faith

- Idaho – Weinstein v. Prudential Property & Casualty Insurance Co., 233 P.3d 1221 (July 1). The insured suing the carrier on an uninsured motorist claim does not have to present direct evidence that an officer or director participated in or ratified the refusal of a claim handler to pay medical expenses before punitive damages can be awarded.

- Washington – Coleman v. American Commerce Insurance Co., 2010 WL 3720203 (September 17). The court in granting insurer's motion for summary judgment confirms that in a first-party context, there is no rebuttable presumption of harm. The insured must prove actual harm, and its damages are limited to the amounts it incurred as a result of the bad faith, as well as general tort damages.

UM/UIM Stacking

- Nevada – Farmers Insurance Exchange v. Lawless, 680 F.Supp.2d 1238 (January 7). Anti-stacking provisions related to underinsured motorist (UIM) coverage in three automobile insurance policies satisfied requirements of Nevada statute governing insurer's ability to limit stacking of UIM coverages, and thus insurer had obligation to provide UIM coverage only under policy applicable to insured's vehicle that he was driving at time of accident, but no obligation to provide additional UIM coverage under policies related to insured's other two vehicles; provision was clear and prominent in policies and insured was charged separate UIM premiums under each policy, since each policy covered a separate and unique risk.

- South Carolina – Nakatsu v. Encompass Indemnity Co., 2010 WL 3853067 (September 29). Plaintiff in UIM case who was driving her own vehicle and who was insured by one carrier became a Class I insured under three policies issued by a different carrier to her sister with whom she resided. As such, she was able to stack the UIM coverages of those policies.

- Missouri – Lynch v. Shelter Mutual Insurance Co., 2010 WL 3922776 (October 7). Since there is no statutory requirement in Missouri that drivers purchase underinsured motorist coverage, the limits of coverage and any stacking or anti-stacking provisions are determined by the contract entered into by the insured and the insurer. Therefore, as long as the policy language disallowing stacking is unambiguous, the anti-stacking provisions will be enforced according to their terms.

Auto – Regular Use Exclusion

- Pennsylvania – Costello v. GEICO, 2010 WL 1254273 (March 25). Regular use exclusions that limit UM/UIM coverage on certain vehicles have been held valid and do not violate public policy interests. 'The general purpose is to give coverage to the insured while engaged in the only infrequent or merely casual use of an automobile other than the one described in the policy, but not to cover him with respect to his use of another automobile that he frequently uses or has the opportunity to do so.

The regular use of other automobiles will bring the exclusionary clause into operation. If the insured's employer assigns him one specific automobile for regular use or a number of automobiles, any one of which may be assigned for a particular trip, the result is the same. An automobile is furnished the insured for regular use in either event. The test for regular use does not consider how often a vehicle, or fleet of vehicles, was actually used, but rather considers whether this vehicle or group of vehicles was regularly available for use on a usual, normal or customary basis.

Tim Lynch is the founding attorney of Lynch & Associates, P.C., a firm that focuses its practice on insurance defense. He may be reached at 907-276-3222; [email protected], www.northlaw.com.

Stacey Stone is an associate attorney with Lynch & Associates, P.C. She may be reached at 907-276-3222; [email protected]; www.northlaw.com.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.