Theft of information and electronic data at global companies has overtaken physical theft for the first time, but most losses are smaller, spanning months and even years, according to an annual fraud survey.

While this may appear to be good news, the frequent repetition of small losses can create a significant problem in the aggregate, according to the Kroll Annual Global Fraud Report (http://bit.ly/dzOpmo).

The survey found that the amount lost by businesses to fraud rose from $1.4 million to $1.7 million per billion dollars of sales in the past 12 months–an increase of more than 20 percent.

The report, commissioned by Kroll with the Economist Intelligence Unit, surveyed more than 800 senior executives worldwide. Nearly a third (29 percent) of the respondents were based in North America; 25 percent in Europe; just under a quarter from Asia-Pacific region; and 11 percent each from Latin America, the Middle East and Africa.

While physical theft of cash, assets and inventory has been the most widespread fraud by a considerable margin in previous reports, this year, theft of information or data was reported by 27.3 percent of companies over the past 12 months–up from 18 percent in 2009. In contrast, reported incidences of theft of physical assets or stock declined slightly from 28 percent in 2009 to 27.2 percent in 2010, Kroll said.

While physical theft of cash, assets and inventory has been the most widespread fraud by a considerable margin in previous reports, this year, theft of information or data was reported by 27.3 percent of companies over the past 12 months–up from 18 percent in 2009. In contrast, reported incidences of theft of physical assets or stock declined slightly from 28 percent in 2009 to 27.2 percent in 2010, Kroll said.

According to the 2010 survey, 88 percent of companies said they had been victimized by at least one type of fraud during the past year. Of the countries analyzed, China is the top market in which companies suffered fraud, with 98 percent of businesses operating there affected. Colombia ranked second with a 94 percent incidence of fraud in 2010, followed by Brazil with 90 percent.

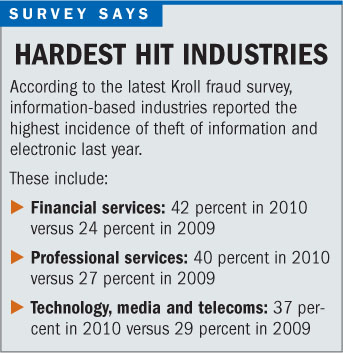

According to the survey, information-based industries reported the highest incidence of theft of information and electronic data over the past 12 months. (See related text box.)

Robert Brenner, vice president of Kroll's Americas region, said in a statement: “Theft of confidential information is on the rise because data is increasingly portable and perpetrators–often departing or disgruntled employees–can remove it with ease absent sufficient controls. At the same time, there is a growing awareness among thieves of the increasing intrinsic value of an organization's intellectual property.”

He added, “Companies need to regularly evaluate how they are controlling access to information within their organization to ensure they are keeping pace with technological advancement and the imperative for collaboration in the workplace.”

Richard Plansky, a managing director with Kroll and head of the firm's New York office, told NU Online News Service in an e-mail that companies are spending less on the information theft risk. “Technology is a double-edged sword,” he wrote. “Businesses tend to see the upside first–technology makes them more efficient and encourages collaboration across the company, among teams and with partners. The downside is that it also makes critical information more easily available to potential fraudsters. There is a growing awareness of this risk, but investment in IT security is still lagging behind it.”

Mr. Plansky noted that in Kroll's experience, “not enough attention has been paid to the risk of data theft and loss, a fact which is reflected in our survey data–77 percent of respondents believe that their companies are vulnerable to information theft.”

Despite the increased risks, however, only 48 percent of companies are planning to spend more on information security in the next 12 months, down from 51 percent last year.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.