They Say, Hearsay

It seems to me that insurance companies are more interested in paying shareholders than claimants. I've read that insurer profitability is improving and can't figure out why that should be good news for me.

We Say

In mid-September, the P&C insurance industry released its national report on the half-year results for 2010 with a headline boasting strong financial results. Healthy insurer finances should be welcome news, but skeptics and critics may not see it that way. Some people, including mainstream media, fail to make a connection between a strong financial position and a stable insurance market.

There is a proverb that comes to mind: He who has health has hope; and he who has hope has everything. Is there hope for a healthy Florida insurance market? Yes, there may be reason for cautious optimism given the regulatory trend of rate increase approvals. From a customer's perspective, however, hearing news of improving financial results along with approaching rate increases won't make much sense unless we explain how a strong insurance market is in everyone's best interest.

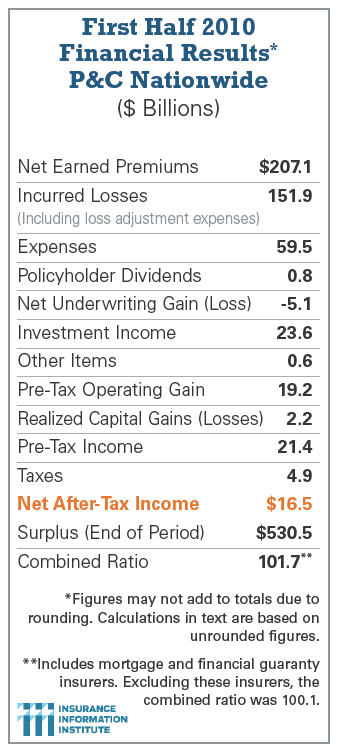

The Insurance Information Institute has a complete analysis of mid-year results available at www.iii.org. Many times when this report is released news organizations pick up details associated with improvements in surplus and rates of return while neglecting to point out how consumers benefit. It is time consumers knew. Mid-year results for the U.S. as a whole show that surplus is improving, which means insurers are well-capitalized and financially prepared to pay very large-scale losses. This is also true for most of the established insurers in Florida.

The Insurance Information Institute has a complete analysis of mid-year results available at www.iii.org. Many times when this report is released news organizations pick up details associated with improvements in surplus and rates of return while neglecting to point out how consumers benefit. It is time consumers knew. Mid-year results for the U.S. as a whole show that surplus is improving, which means insurers are well-capitalized and financially prepared to pay very large-scale losses. This is also true for most of the established insurers in Florida.

It is the word “surplus” that jumps out to policyholders. If we are going to use it, we should know how it is perceived. To customers, it sounds like money in the mattress hidden away from them. The reality is that surplus is capital working for them. It protects policyholders in the event an insurer experiences unexpected claims and helps the insurance industry handle whatever surprises come up, such as multiple hurricanes in a single season. Surplus is strength, allowing companies to write more insurance, which benefits customers by giving them more choices when they shop for coverage. Surplus is definitely a customer benefit that is obscured by the way our financials are reported, and it is an issue to be addressed in conversations with policyholders.

One of the common mistakes made by those outside our industry is thinking that industry financial reports pertain only to one or two lines of business. They should know that all lines of P&C business are included: private passenger and commercial auto, homeowners, commercial property, workers' compensation, medical malpractice, and mortgage and financial guaranty insurers. Some classes of business are performing better than others. Worth noting is how mortgage and guaranty insurers skewed the results for the first half of 2010. They represent just two percent of industry premiums, but ran a negative annualized rate of return of 43.2 percent. That certainly indicates how one area can bias results.

When insurance industry critics report on our financials, they leave out two important details. They give the industry zero recognition for keeping above the fray during the financial crisis of the past two-and-a-half years and they make no mention of the fact that the industry's return on equity is well below the Fortune 500 companies.

P&C insurers were profitable before, during, and after the financial crisis. Profitability means money is on hand to pay claims and it is an indication of the discipline inherent in underwriting and pricing. A lack of discipline is what got banks and other financial companies into trouble, along with the fact that they don't hang onto risk as P&C companies do. Getting kudos for our resiliency may be too much to ask, but explaining to policyholders that private insurers, in general, do not borrow to make investments and do not borrow to pay claims are positive points to make in this economy — or any economy.

There is a clear and practical impetus brewing that encourages people to live within their means, something insurers have been doing all along. Telling the story about how the industry moves with the ebb and flow of the economy and regulatory environment will provide the context to understanding the financials for policyholders who want to know.

Low interest rates and a drop in asset prices mean that insurers are earning less from their investment portfolios. Back in the day when investment returns were robust, insurers could charge less because earnings from investments could be factored into the rate. Those days do not appear to be returning anytime soon. So, insurers will have to rely more on premiums to compensate for lower investment earnings.

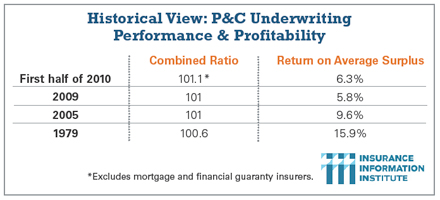

How the weakened investment market has affected the way P&C insurers operate is evident (see the “Historical View” chart). The underwriting performance in each of the four years profiled is nearly identical.

However, the differences in profitability clearly show why an underwriting strategy — not an investment strategy — is driving our business in these economic times.

Lynne McChristian is the Florida representative for the Insurance Information Institute. She may be contacted at 813-480-6446, [email protected]. Also, see www.InsuringFlorida.org for her insurance blog, “Straight Talk.”

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.