Medical professional liability insurers are at a sweet spot in their underwriting cycle. For insurers, it's a place where loss ratios are low, capital is plentiful–and in this case premiums, though under pressure, are only slightly off their peak.

But as any athlete knows, maintaining momentum is a tough proposition, and clear signs of a turn in fortune are already evident. They can be found in the somewhat overlooked corner of insurance known as loss reserves.

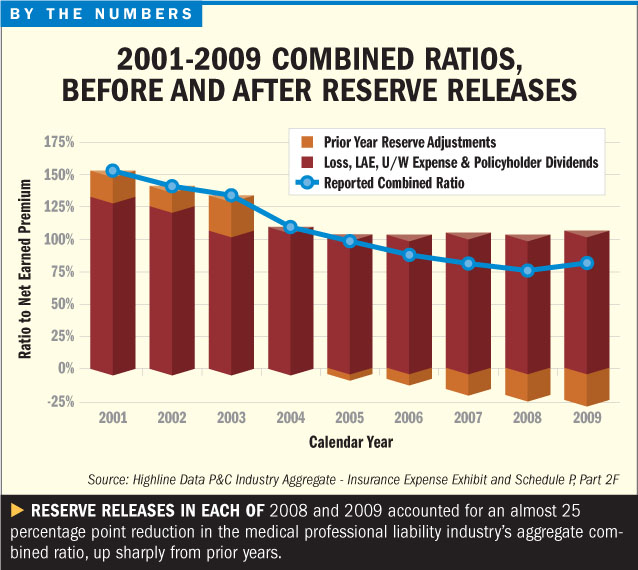

Over the past five years, MPL insurers have released billions of dollars in prior-year reserves. Aggregated MPL industry data reviewed by Milliman shows more than $7.5 billion in prior-year reserve releases from 2005 through 2009, with well over half of the amount booked in the last two years of the period.

As the accompanying bar graph indicates, reserve releases in each of 2008 and 2009 accounted for an almost 25 percentage point reduction in the MPL industry aggregate combined ratio, up from a 20 percentage point reduction in 2007, and sharply up from 5-to-10 percentage point impacts in 2005 and 2006, respectively.

Reserve takedowns, however, are not a novel phenomenon in the world of MPL, where loss volatility is a fact of life, the initial estimate of a loss is just that–an estimate–and is revised over time as losses approach their ultimate value.

Reserve takedowns, however, are not a novel phenomenon in the world of MPL, where loss volatility is a fact of life, the initial estimate of a loss is just that–an estimate–and is revised over time as losses approach their ultimate value.

Reserve adjustments are a necessary part of the process in arriving at an accurate picture of an insurer's financial health, but they do not occur in isolation.

As loss trends increase, there is an upward pressure on rates and insurers see the need to strengthen reserves, which in turn inversely affects surplus.

But as insurers gain comfort about their capitalization, reserves may be released and enhance surplus or pay dividends, and with their release, premiums tend to slacken and policy terms and conditions are often relaxed, giving rise to a soft market where policy terms are favorable to buyers.

The conditions that now dominate the MPL market in many ways resemble the soft market that followed the steep rate increases that occurred during the mid-to-late 1980s. Conditions then resulted in earned premium soaring some 145 percent before insurers started to take down reserves that had built up over the period due to loss trends leveling out before premiums halted their climb.

This period of revenue and capital growth were then followed by a falloff in premium and a release in reserves as insurers reassessed their expected future claims and reevaluated rate adequacy.

In 1989–the advent of the previous soft market–insurers released $1.5 billion in reserves. By 1994, reserve takedowns reached $2.1 billion, or 24 percent of net written premium, before tapering off over the next five years when the calendar-year loss and loss adjustment expense ratio soared to more than 130.

At the same time, investment income–a critical buffer to the profitability of a long-tail line like MPL–also failed to mitigate the dual devastation of falling premiums and soaring losses, which had dragged down industry results by the late 1990s.

From 1998 through 2001, MPL insurers–victims of an extended low interest-rate environment that continues today–saw investment income topple because of a decline in interest rates on bonds and other fixed-income securities, which make up some 80 percent of the investments.

If history is a guide to the future, then current MPL results are likely to deteriorate over the next few years. The big question now before insurers is this: How long will the industry be able to head off combined ratios of 130 or more?

If the present cycle were to follow the same trajectory as the previous one, insurers could expect that reserves will prop up earnings for the next few years.

But following this path, by 2014 the combination of inadequate pricing and shrinking reserves could cause the combined ratio to once again climb well above underwriting breakeven of 100.

However, the forces that drive the MPL market rarely converge in quite the same way.

Premium increases of the most recent hard market were not as large as those of the previous cycle and took longer to develop. Moreover, reserves have been released at a faster pace.

There are also signs that the improvements in claims frequency–which happened to occur as insurers started to take hefty rate actions in the early 2000s, and contributed to insurers' recent good fortune–may have started to abate.

If frequency trends were to reverse–a plausible scenario, considering many of the still unanswered questions surrounding their improvement–insurers' prior-year reserves could be exhausted sooner than they were in the previous cycle.

In addition, changes in the regulatory or legal environments could tamp down MPL insurers' results in the years ahead.

For example, in February, the Illinois Supreme Court ruled that a 2005 law to cap certain types of MPL awards against doctors at $500,000, and judgments against hospitals at $1 million, was unconstitutional.

Meanwhile, opponents of a cap on non-economic MPL awards in Missouri have attacked the reform on similar legal grounds, and tort reforms have come under close scrutiny in other jurisdictions.

A reversal in any one of these factors could increase insurers' claims or operating costs and deplete insurers' reserves sooner than expected.

If that were to happen, combined ratios of 130 or more may be here even sooner than anyone realizes.

Richard Lord, FCAS, MAAA, is a principal and consulting actuary in the Los Angeles office of Milliman and may be contacted at [email protected].

Stephen Koca, FCAS, MAAA, is a consulting actuary in the Los Angeles office of Milliman and may be contacted at [email protected].

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.