The failure of Congress to approve long-term renewal of a revamped National Flood Insurance Program could jeopardize the participation of private carriers, an official with the Federal Emergency Management Agency warned state insurance commissioners.

Addressing regulators in Seattle at the National Association of Insurance Commissioners' summer meeting, Edward Connor, acting Federal Insurance and Mitigation Administrator, said with the Sept. 30 deadline for the latest expiration of NFIP looming, he worries about what effect that will have on private company participation.

"That is when 90 companies say if they want to participate in the plan," he said during an NAIC Catastrophe Insurance Working Group session. "It is a significant concern to us."

"That is when 90 companies say if they want to participate in the plan," he said during an NAIC Catastrophe Insurance Working Group session. "It is a significant concern to us."

In July, the current program was given an extension to Sept. 30 as Congress works on a five-year reauthorization package.

While the House Of Representatives has passed a five-year extension bill, the Senate has taken no action, prompting Mr. Connor to point out that "Sept. 30 is coming up real fast, and we do not want to wait until the last minute."

His observations came after Florida Insurance Commissioner Kevin M. McCarty and Mississippi Insurance Commissioner Mike Chaney spoke about the need for a reliable flood insurance program that does not put homeowners in jeopardy of being without the coverage.

Commissioner Chaney said he is frustrated as a regulator that there is not a "solid" program in place, and Commissioner McCarty called it "a travesty" that a program affecting so many policyholders and that is vital to the housing and real estate industry is not in better shape.

Mr. Connor said FEMA and NFIP administrators are as "frustrated as you are" about the current state of the program, but their hands are tied by Congress.

Without Congress' approval of the NFIP legislation, he said, the program loses its $27 billion of borrowing authority that can be used to cover claims and expenses. And without that money, renewals are jeopardized and banks and federal lenders could cancel borrowing, or close on existing loans in the most extreme cases–though Mr. Connor noted banks have not shown a desire to do so thus far.

He said one plan–to allow a gradual increase in premiums–is not helping the program. The plan would mean rates would not reach an actuarially sound level for 10 years. "I need actuarial rate today," he said. "I can't wait 10 years."

To make it more affordable for homeowners, the program is considering an installment payment option, but Mr. Connor said development on that front is in its infancy and he could offer no insight into what such a schedule would look like.

It appears that Mr. Connor has good reason to worry, as the NFIP extension approved by the House in July (http://bit.ly/dyIlpx) is unlikely to pass the Senate before the program's next scheduled expiration on Sept. 30, representatives for two national agent groups said.

Rita Hollada, the National Association of Professional Insurance Agents' representative to the Flood Insurance Producers National Committee and a former FIPNC chair, said the expectation she is hearing is that if the program is reauthorized without lapsing again, it will probably be another short-term extension to Dec. 31 to bide time until the next Congress can act on proposed reforms.

John M. Prible, assistant vice president for federal government affairs for the Independent Insurance Agents and Brokers of America, said IIABA is grateful to the House for passing the five-year extension, H.R. 5114, but added "it's somewhat unlikely the Senate will act."

The reforms, which have been debated since Hurricane Katrina left the NFIP nearly $18 billion in debt, are contentious in the Senate, he said, adding he does not see senators coming to an agreement over the next month.

He said while it may be unrealistic to ask for the five-year extension, another three- to six-month reauthorization is not a good strategy. Mr. Prible said legislators have been using short-term extensions and looming deadlines as "a stick" to force the issue on a long-term bill with reforms.

"I'm beginning to question the effectiveness of that strategy since it seems everyone is very willing to call [each other's] bluff," he said.

Ms. Hallada said the flood program had been paying for itself prior to Katrina, but the 2005 hurricane was "such a huge shock loss" that the program suffered far more losses than it could cover, and it was forced to borrow money from the Treasury.

The NFIP, she said, feels that Katrina was an aberration, and that the program is well-suited to handle losses in a "normal year." She added that the NFIP would like Congress to forgive the debt since it sees Katrina as an anomaly, but the House "is not amenable to forgiving the debt."

Critics in Congress, Ms. Hallada said, feel the program is broken and want to enact reforms. Meanwhile, she noted, others in Congress are applying pressure to increase available coverages provided by the NFIP.

Rep. Gene Taylor, D-Miss., for example, wants to add wind coverage to the program to resolve future "wind vs. water" disputes.

Ms. Hallada said other legislators feel their constituents did not get full recovery under their flood policies after disasters and are seeking to add coverage for economic losses.

The program, meanwhile, is "caught between a rock and hard place," according to Ms. Hallada, because, by statute, rates cannot be increased by more than 10 percent per year. The program, she noted, is under pressure to add coverages and recover premium to pay its debt, but it cannot raise premiums enough to do so.

As Congress continues its strategy of passing short-term extensions, the program has lapsed several times, most recently in June. Indeed, facing another expiration deadline on Sept. 30, agents are advising clients to pay renewals for flood policies in advance of the deadline in case there is another lapse, agent leaders note.

Additionally, Mr. Prible and Ms. Hollada echoed Mr. Connor's warnings at NAIC that the "Write-Your-Own" private insurers that write and administer federal flood insurance policies are considering abandoning NFIP altogether because of multiple lapses and continued gridlock in Congress.

Howard Olderman, president of the Professional Insurance Agents of Connecticut, said some clients became angry with him over the lapses. While the blame rested with Congress, customers only saw his office and his name as they suffered delays and uncertainty. "Some of them believe the insurance company and the flood program is in my office," he said.

But the main problem for agents and others as the flood program has repeatedly lapsed has been the confusion caused.

Mr. Prible said it is a challenge for agents to have to explain everything to frustrated clients when the program lapses.

"You think it maybe gets easier because it happens so often," he said, but he noted that lapses throughout the year impact different batches of customers. For every lapse, he said, "our guys constantly have to explain what Congress is doing, why [the program] expired, what FEMA is saying…."

And agents are not the only ones who have to deal with flood program administration headaches. Both Mr. Prible and Ms. Hollada said they are hearing that insurers are growing frustrated and are re-examining whether they want to continue selling policies on behalf of the NFIP.

Should private insurers pull out of the program, the NFIP would have to sell flood policies directly, according to Ms. Hollada, who said the NFIP "isn't equipped to handle that kind of volume."

Mr. Prible added that agents, philosophically, would rather work with private insurers than the government.

Other carriers, Ms. Hollada said, are beginning to write flood coverage as part of a homeowners policy. Some had previously written flood coverage as an excess policy, offering insurance above that provided by the NFIP, she noted, but now some carriers are offering to be the primary insurer.

The private sector picking up the risk and charging adequate rates "would make life so much simpler" compared to dealing with the NFIP, Ms. Hollada said, but she acknowledged there would be consequences. Insurers would cherry-pick risks, taking the favorable ones and leaving the flood program with the highest-risk properties, which could imperil the program further.

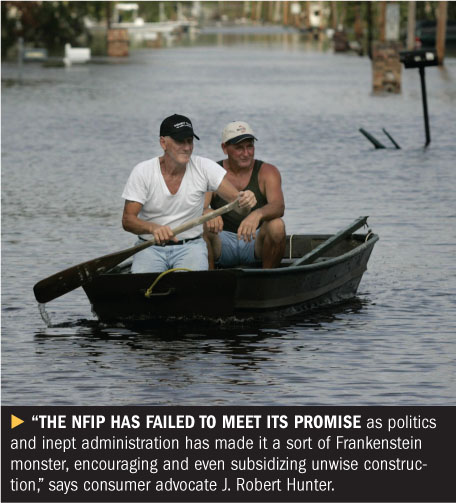

J. Robert Hunter, director of insurance for the Consumer Federation of America, argued in a letter to Congressional leaders that private insurers should take up most of the risk and that the NFIP should either be ended or completely restructured.

He said the program has encouraged rather than dissuaded people from building along risky coastal areas. He also said old maps fool homeowners into thinking they do not need flood coverage when they are really at risk.

Mr. Hunter added in his letter that the NFIP is bankrupt and is, according to the Government Accountability Office, a "high risk" program for the American people. In addition, he said that insurers participating in the NFIP's Write Your Own program overcharge for administrative and claim settlement duties.

"I ran the program in the 1970s and loved doing so because I thought it would end unwise construction in high-risk coastal and river areas while providing affordable coverage for people who really needed it," wrote Mr. Hunter, a former federal insurance administrator.

"However, the NFIP has failed to meet its promise as politics and inept administration has made it a sort of Frankenstein monster, encouraging and even subsidizing unwise construction," he added.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.