Washington

Attempting to ease concerns that independent agents are going to be forced out of the health insurance market by the still to be implemented federal reform law, the National Association of Insurance Commissioners has created a task force to examine ways of ensuring that agents continue to be key players even after health care exchanges are launched in 2014.

Kansas Insurance Commissioner Sandy Praeger, who chairs the NAIC health care task force, supported that goal during a recent meeting of several commissioners with reporters at a conference on health reform implementation held here by the association of state regulators.

Kansas Insurance Commissioner Sandy Praeger, who chairs the NAIC health care task force, supported that goal during a recent meeting of several commissioners with reporters at a conference on health reform implementation held here by the association of state regulators.

"A number of us feel very strongly about the important role agents play in providing advice and counsel to thousands of Floridians and Americans across the country in making critical health care decisions," said Florida Insurance Commissioner Kevin McCarty.

Under the new federal reform law, administrative and other costs must be limited to no more than 15 cents of every health insurance premium for large group policyholders, and no more than 20 cents for small group and individual buyers.

These "medical loss ratio" benchmarks have raised concerns among independent agents, many of whom augment their property and casualty insurance sales with a substantial group health business.

The problem for agents is that currently, the sale of small group and individual policies earn commissions as high as 20 percent, without accounting for all the other administrative costs health insurers face.

Representatives of agent groups–specifically the Independent Insurance Agents and Brokers of America, the National Association of Health Underwriters, and the National Association of Insurance and Financial Advisors–have been working with the state commissioners to ensure that their role in the health care industry is assured going forward.

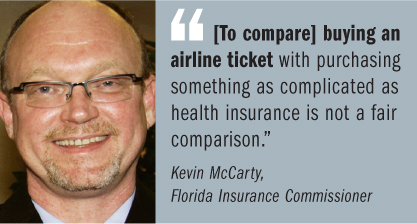

Mr. McCarty conceded that some people have suggested the insurance exchange program will lessen the role of agents.

"I disagree with that," he said, adding that "agents serve as a valuable tool" in providing health care, "and we are working to protect the integrity of the relationship."

Mr. McCarty noted, however, that the state commissioners will seek to accomplish that goal "while maintaining the transparency and integrity of the new law."

He added that agents provide comprehensive advice when selling and servicing health insurance policies. He said that comparing "buying an airline ticket with purchasing something as complicated as health insurance is not a fair comparison."

The MLR regulations must be in place before Dec. 31, noted NAIC President Jane Cline, who is West Virginia's insurance commissioner.

The commissioners brought up several issues in their meeting with reporters and said they are working hard with state Medicaid directors, health departments and other regulators to reach consensus on rules governing components of the health care reform law.

Under the new law, the state commissioners make recommendations on how to implement certain provisions of the Patient Protection and Affordable Care Act, which must then be approved or may be modified by the U.S. Department of Health and Human Services.

In related news, a bipartisan group of 25 members in the U.S. House of Representatives have asked federal health regulators to ensure a role for licensed insurance agents in the Web portal that will be used to aid consumers in comparing coverage options.

In related news, a bipartisan group of 25 members in the U.S. House of Representatives have asked federal health regulators to ensure a role for licensed insurance agents in the Web portal that will be used to aid consumers in comparing coverage options.

The Department of Health and Human Services unveiled the portal July 1 on a trial basis. An update with more comprehensive information is scheduled to be in place as of Oct. 1.

The portal is seen as a precursor to the health insurance exchanges that will be launched in 2014 under the Patient Protection and Affordable Care Act.

"We strongly encourage you to include the ability for consumers to contact certified, state-licensed independent health insurance agents and brokers for assistance when comparing coverage options," a letter from the House members said. "It is important the consumer's options to contact independent and state-licensed health insurance agents and brokers be included no later than Oct. 1."

Rep. Charlie Melancon, D-La., originated the letter, and eight Democrats and 17 Republicans signed it.

"It is our belief that consumers will benefit from this arrangement and will respond positively to the new portal method of purchasing health insurance if they are able to access the personalized service of an insurance agent or broker," the letter said.

Only three Democrats who voted for the legislation signed the letter: Rep. Leonard Boswell of Iowa; Rep. Baron Hill of Indiana; and Rep. Adam Smith of Washington.

An official of the National Association of Health Underwriters confirmed that NAHU played a role in having the House members sign the letter.

John Green, NAHU vice president of congressional affairs, said independent agents should certainly play a key role in counseling people about their health insurance options going forward.

"Providing consumers with the option to choose a local agent at the ZIP code level to assist them in choosing the right coverage for the individual or family makes sense," he said. "You wouldn't want to call Washington to find out your home or car insurance options. You want someone you can look in the eye and call in the middle of night."

On the portal issue, the 25 members of Congress noted that in writing the health care reform law, "Congress made sure to explicitly include provisions to give consumers access to independent and state-licensed health insurance agents and brokers in a reformed health insurance marketplace, both inside and outside health insurance exchanges."

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.