They Say, Hearsay

It's painful to watch the oil spill in the Gulf of Mexico smear the environment. This disaster will have a lasting impact on land and sea, and the economic damage done to all the businesses in Florida who rely on the water and tourism also will last a long time. How can anyone be sure that insurance claims related to the oil spill will be paid?

We Say

Insurance losses from the explosion and sinking of the Deepwater Horizon oil well are expected to be the largest ever for global offshore energy insurance and reinsurance markets. The question is if the pockets of private insurance covering energy platform risk and the pockets of British Petroleum (BP) are deep enough to pay them. In a word, the answer is yes.

Under the Oil Pollution Act, BP has the liability to pay for clean-up costs, and it has vowed to pay for all "legitimate claims" caused by the oil spill. The estimate for private insurance industry losses related to the Deepwater Horizon oil rig are between $1 billion and $3.5 billion. Because energy risks are spread globally across a broad range of insurers and reinsurers, these claims are manageable.

The bigger question is how BP's self-insurance will work over what may be years of claim payouts related to business interruption and loss of income. (Of course, there will be numerous lawsuits against BP, equipment manufacturers, suppliers and others, but I will leave that subject to others.)

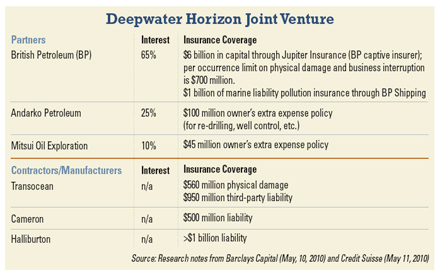

First, some background. The Deepwater Horizon oil rig is a joint venture with 65 percent interest owned by BP, 25 percent interest by Andarko Petroleum, and 10 percent interest by Mitsui Oil Exploration. Each has insurance mechanisms in place (see chart on page 18). Claims filed under first-party insurance policies will be easier to manage, thanks to the standardized policy forms that offer predictability about what is covered and what is not. Third-party claims are another story. Complex insurance programs structured by oil companies use non-standard policies, and such policies often lead to interpretations of policy language after large-scale mishaps.

Businesses owners will likely wonder if their business interruption insurance provides economic relief from losses related to the oil spill, and if not, why. The Insurance Information Institute encourages business owners to have a conversation with their agents about these coverage questions. It is an opportunity for agents to explain how business interruption insurance works — requiring direct physical damage to a property before the coverage kicks in. Some business owners, particularly those in the hospitality business and commercial fishing, are already suffering from the mere perception that oil is washing over many of our beaches. If that perception becomes reality, consumers will question the value of business interruption coverage — along with our value as insurance professionals if we are not proactive about recognizing that catastrophic events can be educational platforms.

In addition to explaining how business interruption insurance is linked to property insurance, we also must point out the pollution exclusion, which can lead to a discussion on the need for flood insurance. The National Flood Insurance Program (NFIP) issued some bullet points to address concerns over oil in the gulf mixing with flood waters this hurricane season, explaining how coverage would work if a hurricane or another event mixes oil with flood waters:

? Under the terms of the General Property Form of the Standard Flood Insurance Policy (for commercial buildings, with property and contents coverage purchased separately), damage caused by pollutants is limited to $10,000.

? Under the Dwelling Form and Residential Condominium Building Association Policy Form, damage to the building and contents (with both coverage types purchased separately) from pollutants is paid up to policy limits.

? Damage to ground, soil or land caused by flood, oil, or flood water mixed with oil is not covered by NFIP policies.

At the time this article was written, the federal government was looking at setting up a fund to speed up claims payments to those affected by the oil spill. Establishing such a process may not be efficient in the short term. However, as the effects of the oil spill disaster linger, it may be the best way to bring consistency and fairness to the claims process.

Another major catastrophe has caught the world's attention. While we as insurance people cannot fix the problem offshore, we can do something to address its aftermath. We should be reaching out to our clients with answers now to help them understand their insurance contracts before they are forced to ask us questions.

Lynne McChristian is the Florida representative for the Insurance Information Institute. She may be contacted at 813-480-6446, [email protected]. Also, see www.InsuringFlorida.org for her insurance blog, "Straight Talk."

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.