These are unparalleled times in the insurance marketplace and the economy. The Great Recession, Chinese drywall, the Deepwater Horizon oil spill, the failure or near-failure of numerous “too big to fail” companies like AIG, high unemployment, and the housing and mortgage industry meltdowns have made even the most robust businesses wary.

The E&S segment of the insurance industry has historically been able to move independently from other financial service sectors. In the past, a downturn in the economy has led to strengthened pricing as insurers tightened their underwriting guidelines. Today, however, E&S carriers face pricing pressure due to the highly competitive environment within the E&S community itself and from the voluntary market. While the case for a market firming can be made, certain basic underlying principles are preventing that from happening.

First and most notably, the principle of supply and demand, which dictates that the price for a good or service will rest at the point that the supply of that good or service meets its demand. Given a steady supply with increased demand for a good or service, the agreeable price point also increases. Conversely, when supply increases at a rate faster than the demand, the price point drops — a simple yet powerful premise when considering risk transfer products.

Florida and neighboring states know well the supply and demand principle and its impact on the insurance marketplace. After 2005's Hurricane Katrina, insurers established a premium charge to ensure that their capital would be present to pay claims in the event of a covered loss. The roughly $40 billion reduction in surplus and resulting reduction in capacity (supply), forced the price point higher due to an unchanged level of demand. The past five years have been relatively benign from sudden capacity-draining events such as hurricanes, giving insurers the opportunity to replenish their capital funds through earnings. With their increased capital positions, many have grown impatient to write more business.

On the demand side, the population of Florida's coastal counties has nearly doubled over the past two decades, and insurers have eagerly taken advantage of that tremendous growth. The Insurance Information Institute reports that Florida is the most exposed state for hurricane loss, with a total insured value of some $2.5 trillion. According to the federal Government Accountability Office, the Florida Hurricane Catastrophe Fund and Florida Citizens Property Insurance Corp. alone account for more than $2 trillion.

On the demand side, the population of Florida's coastal counties has nearly doubled over the past two decades, and insurers have eagerly taken advantage of that tremendous growth. The Insurance Information Institute reports that Florida is the most exposed state for hurricane loss, with a total insured value of some $2.5 trillion. According to the federal Government Accountability Office, the Florida Hurricane Catastrophe Fund and Florida Citizens Property Insurance Corp. alone account for more than $2 trillion.

The aggregation of values along the coastline has prevented the collective insurance community from gaining an actuarially sound spread of risk, which is imperative for the insurance mechanism to function independently. Despite most insurers' focus on reducing concentrations of exposures, there are still substantial pockets that if hit would be crippling to the industry. Given today's pricing environment, many stakeholders question the long-term ability of insurers to take on more risk

In 2004, Florida sustained four hurricanes that produced $22 billion in insured losses. Though the combined effect of those hurricanes surpassed the damage from Hurricane Andrew in 1992, the robust economic environment helped to offset these sustained losses. Imagine for a moment if those losses were to occur in today's environment.

Despite some signs that the economy is beginning to recover, there is still much concern that a full economic recovery will be slow in developing, which would hamper an insurer's ability to replenish the outflow of capital. While an insurer's success often can be attained regardless of the economic environment, the challenge increases significantly if capital is either unavailable or very expensive.

Voluntary Markets Encroach Into E&S

Proper management of exposure to catastrophic events is imperative for the longevity and survival of carriers that write catastrophe-exposed risks. Because of the need to limit the amount of property aggregation, carriers have become increasingly willing to aggressively target other lines of business as a means of diversification, writing business at questionable rate levels to book premium. The relatively unscathed surplus supply that is available is driving down rate levels in many lines of business as carriers look to grow or maintain their top line revenue number. The price and rate decreases are the initial tools to lure the business in, followed by broadened terms and throw-in coverage extensions.

The major roles of E&S lines companies are to provide extra capacity for accounts requiring large limits and to underwrite risks requiring a unique approach. The past two years have been increasingly difficult for E&S companies from a liability perspective when providing terms for hard-to-place liability risks. Two factors are driving the difficulty: Increased competition from standard lines carriers and the erosion of the underlying rating basis resulting from the economic downturn.

As admitted carriers have broadened their appetite they have increased the amount of risk they are willing to accept. They are accepting — even pursuing — accounts that they normally would not write in a harder market when surplus is less and the guidelines to preserve the supply of capital are tighter.

Imagine for a moment that it is 2006, and a manufacturer of widgets is enjoying a successful year with sales topping $5 million. The carrier is providing coverage at a rate of $10 per $1,000 sales, equating to a $50,000 premium. Fast forward to 2009-2010. The same manufacturer's sales have now dropped to $2.5 million. Assuming the carrier has been able to fight off competition and can still charge the same $10 rate, that $50,000 premium has now been cut in half to $25,000. The reality is that the $10 rate is probably somewhere in the neighborhood of $6 to $7.50, further reducing the revenue to the insurer. However, the exposure from prior years' operations likely remains the same or has increased slightly with age.

Although the exposure for the carrier has been cut in half for this policy, the fixed costs that are associated with the policy maintenance have increased on a percentage of premium basis, ultimately making less premium available to pay future claims. The carrier is forced to look for more accounts to replace the premium that has essentially vanished, and turns to the E&S markets. (This example neglects the presence of investment income, which has proven to be scarce during this time period.)

E&S Market Remains Challenging

This scenario is not unique to E&S companies. It does, however, impact the E&S community more adversely as it is commonly seen as the “safety valve” of the insurance industry. This implies that risks unable to find necessary coverage from an admitted carrier will turn secondarily to the E&S market segment for a solution. According to A.M. Best's 2009 U.S. Surplus Lines – Market Review, the top twelve U.S. domiciled insurers that primarily write surplus or specialty admitted business had a 12.7 percent reduction in direct premiums written in 2008. This is compared to a 2.6 percent reduction of direct written premiums for the total property and casualty insurance industry. The 2010 report will be out later this year, with the downward trend expected to continue.

So, in the near term, the E&S marketplace remains challenging. It all goes back to supply and demand. The supply of capacity is relatively abundant compared to the demand. Until there is an increase in demand (which will stem from an economic recovery), carriers will continue to compete aggressively on business, shaving it down to the thinnest margins. Although there are some signs of rejuvenation, many experts believe that the path to economic recovery will take us into 2011.

Assuming a surge in demand is off the table, the focus turns to the supply portion of the equation. In the past five years, there have been few events that have had an immediate impact on capacity. Relatively benign storm seasons have allowed insurers to replenish capital through earnings. These results, coupled with reserve redundancies from more favorable underwriting years, have given insurers a bit of a cushion on which to rely.

As those reserve banks dry up, carriers will be unable to offset diminished underwriting results generated from a competitive environment. They will instead need to examine their underwriting guidelines and the composition of their books to protect their surplus. Products determined to be non-core will be spun off in an effort to return to profitability; a hard market may appear.

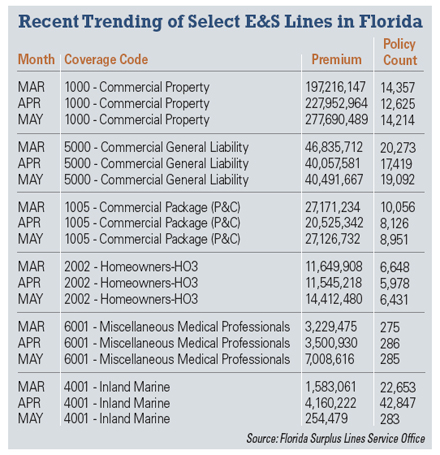

Encouraging Signs in Florida

The Florida marketplace is beginning to see small signs of this purging effect. While the exit of a few players from some classes does not make a trend, it does demonstrate that carriers cannot afford to grossly under price the market in a particular segment and enjoy long-term success. We are just beginning to see this exiting of classes that signals a change in the market. However, as long as overall surplus remains abundant, the carriers who are leaving will be replaced by ones looking to add to their top line results. Hopefully they will approach these newly identified opportunities with discipline. There is an industry adage that summarizes these opportunities, “Never allow the sweet aroma of premium to overpower the stench of losses.” This is a creed all carriers should live by.

As we move through this market cycle, the responsibilities of all parties involved in the insurance transaction increase and become even more important. To protect the insured, we all have areas of focus:

Insurance carriers – Remain disciplined despite the pressure that top line reduction places on bottom line results. A challenging market is the time for entrepreneurial spirit to blossom. Focus on methods to increase the efficiency of the insurance mechanism, reducing the impact of the expense ratio.

Insurance agents – Fully understand the climate in which we are operating and the serious challenges that lie ahead. Examine the financial stability of the markets where you are placing business. Educate insureds on the importance of carrier longevity.

Rating agencies – Ensure consistent and objective analysis of carriers.

State agencies – Do not allow political pressure and public opinion to override the primary objective of protecting the policyholder. State insurance agencies have a responsibility to ensure that coverage is fair and reasonable and to guard against destructive competition.

With the future so uncertain, we must collectively continue to examine opportunities carefully and thoroughly to take advantage of growth opportunities. It all comes back to supply and demand and the protection of our supply while demand is stagnant. The careful management of supply now will reap tremendous rewards when the business environment changes — as it always does.

Nick Abraham, CPCU, ASLI, ARe, is the manager for P&C binding for Markel Corp., southeast region. He may be reached at [email protected].

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.