Insurance companies' track records regarding new technologies may indicate the industry will not be among the leaders in adopting digital marketing tools such as e-mail, blogs, social networking, and Twitter. But Catherine Stagg-Macey, a senior insurance analyst for Celent and author of “Digital Marketing in Insurance: A Partnership With Potential,” believes the low expense levels in adopting such marketing tools do make them attractive for insurance carriers.

(For a look at the pluses and minuses of social media, click on this article.)

“It doesn't require lots of spend,” says Stagg-Macey. “You can try things at a fairly low price, assuming you have the appetite to do that. If we take that in consideration, we could expect to see a little more innovation than we have seen before in insurance. I wouldn't say leadership but perhaps following more quickly. At the moment, it looks like the U.S. is a little ahead in adapting to social networking than the UK is.”

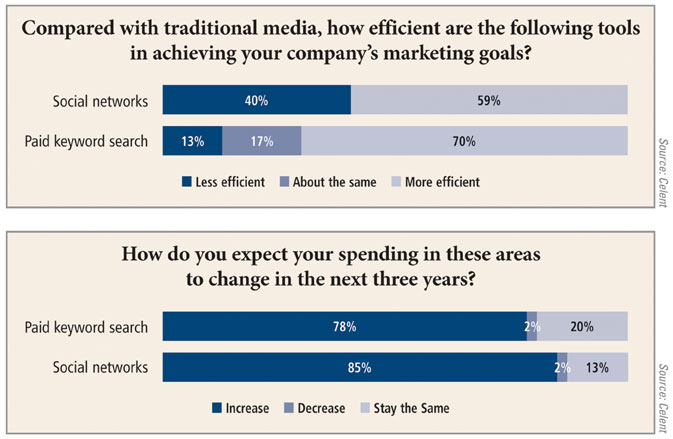

Responses to Celent's survey of insurance carriers on the subject suggest digital media such as e-mail and paid keyword search are dominating digital marketing budgets for insurance carriers, Stagg-Macey reports. “These methods are seen as considerably more effective than traditional marketing means,” she says.

Many of these digital marketing tools have been used for the past decade, but Stagg-Macey points to the use of newer tools, such as online games, social networks, and blogs, as being an increasing area of today's marketing budgets.

“Within the next three years, respondents expect social networks to be one of the top three focus areas for digital marketing,” she says. “This prioritization reflects the expectations this channel will be a rich alternative to traditional media.”

The use of paid keywords in search engines in marketing insurance carriers has had positive results because of its low costs, explains Stagg-Macey. For example, insurers can set up a campaign around the search for the term cheap car insurance.

“How much you pay depends on how popular that search term is,” she says. You can use any keyword you want–whatever combination of words your end customer is looking for. You pay the number of times your ad appears. It's a great way to do targeted marketing.”

Stagg-Macey observes customer behavior is changing to reflect the expanded options available to purchase insurance products. In the Celent survey, respondents believe 60 percent of their customers are searching for insurance information online.

The survey also indicates insurers believe 45 percent of customers are being made aware of new products through digital marketing, 44 percent of customers are using digital services, and 43 percent compare prices online. “I think those numbers are an argument for why insurers need to take this seriously,” says Stagg-Macey. “If your customers are out there in the digital world looking for information, you need to make your presence known.”

Digital marketing tools have earned the support of marketing people through their effectiveness, continues Stagg-Macey. When asked to rate the efficiency of digital tools compared with traditional media, respondents were solidly on board with digital marketing, particularly with tools such as e-mail, which 68 percent of respondents rated as more efficient than traditional mail.

The only area that seems to be lagging today is in the actual purchase of insurance products online–only 32 percent of respondents indicate their customers are buying insurance policies on the Web.

“I think buying products online is an interesting area to watch,” says Stagg-Macey. “Here in the UK, buying insurance online is fairly common, particularly in motor insurance. We are quite happy to buy online, put our credit card details out there, and be immediately covered. I would expect over time that number would go up [in the U.S.].”

Robert Regis Hyle

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.