Are insurance agencies like law firms? Say it isn't so! Many law firms, some of which have deserved reputations for outstanding advocacy on behalf of their clients, are notoriously inefficient and poor places to work. That's because most of the attorneys are so busy lawyering, they don't have time to pay any attention to how their office operates.

So it is with insurance agencies. Many of us are so busy searching for new business, protecting our renewals, servicing our clients and keeping up with evolving interpretations of policy coverages that we don't have much time left to make sure our office is running efficiently and effectively. I've seen many competent agents, but not very many well-run agencies.

Read Philip Lieberman's September feature “An additional insured: A false sense of security.”

Let's focus on major management issues all of us confront in our agencies:

o Processes

o Communication

o Client relationships

o Employee attitudes

o Training.

Within these areas, you will gain some practical, usable insight into how you can improve the management and operating effectiveness of your firm.

Let's start with processes or how things are done internally. A well-run office needs disciplined but workable procedures. But not a dull, one-size-fits-all-agencies formula; the nuts and bolts of daily transactions can effectively carry out your company's service philosophy. How can processes be improved when dealing with:

o New business marketing

o Renewals

o Policy changes/audits

o Administration

o Claims

o Financial/accounting.

First, I strongly recommend that you build an operations' manual within your agency. Remember that you don't have to do it all at once and, believe it or not, you can get your employees to help compile it.

New business marketing

This is a subject near and dear to us all, especially in today's soft marketplace. Assuming your agency has managed to put you or your producer in front of a prospective client, what can be done to optimize the chances of presenting a dynamite proposal and perhaps landing a new client?

To market or not is your first decision. None of us have infinite resources, so don't be a sucker–not all prospects are worth the effort. While every producer thinks every prospect is a winner, I your marketing manager use an evaluation matrix. The matrix asks four pertinent questions:

o Is this a realistic competitive opportunity? Or are you the fourth out of five brokers quoting?

o Do you have adequate time? Or does everything have to be put together within a week or 10-day time frame?

o Is there sufficient premium? Or are you chasing an $800 BOP in the hopes that you'll get in on the ground floor of a business that's bound to grow?

o Is this our kind of client? Or are they outside of our area of expertise and experience? Have they had lots of claims? Does the client's principal seem a little shady?

The trick is to get your producers to buy into the rationale and the validity of such a matrix. You need to convince your producers that weeding out the time-wasters will benefit the producer and the agency, leaving time and resources to be used for more potentially valuable prospects.

Assuming you have a prospect that passes the matrix test, mandate the use of a standardized input document. Does your producer sit in front of the client with a blank pad? Use a checklist of some kind? Fill out an ACORD form? Does every producer do it differently, thereby making tons of friends in the marketing department?

A standardized input document (see attached) has several advantages:

o It is easier to use than an ACORD application and develops more information that your underwriter will need. Sure, some of the information will eventually have to find its way into an ACORD app, but it's still better than using the app itself at an initial conversation with the prospect.

o It is designed to flow with the interview conversation, so your inquiries are more engaging and less off-putting to the prospect.

o It serves as a checklist, so that the need to go back for more information is minimized.

o It puts valuable information in a compact document for your agency management system.

o It is designed to make a narrative for the underwriter easy to construct (more on that later).

o If you're successful, the marketing section helps in capturing and servicing the account.

There's a lot of information here, and it may not be possible to get it all at one meeting, especially the loss information which is bound to come later. You can arrange for a follow-up meeting to receive the remaining information and leave a separate driver information form for the prospect to complete and send to you.

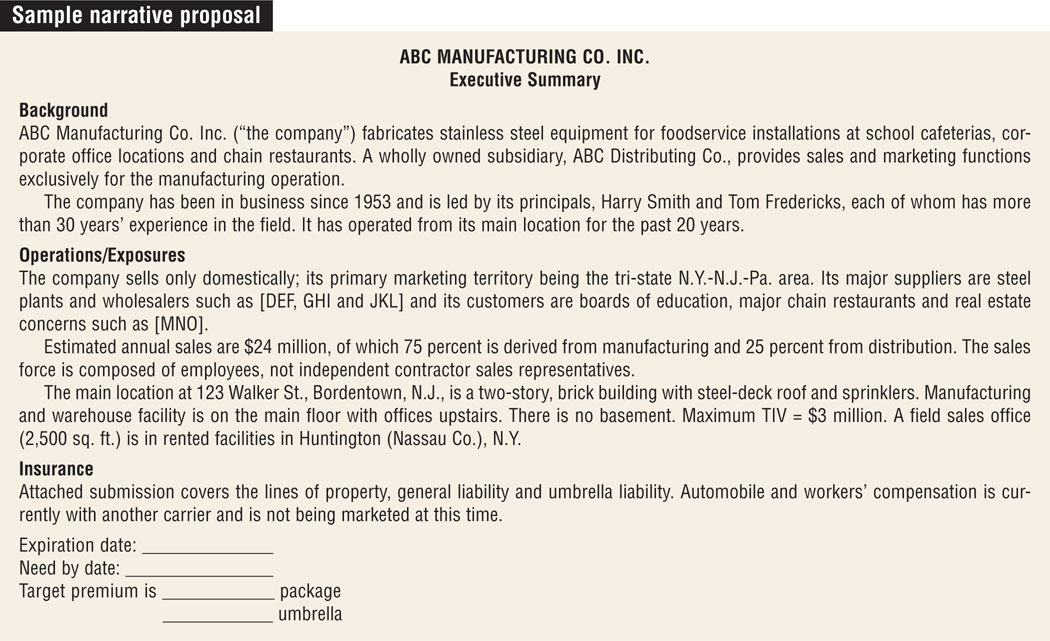

In marketing the account, one of the ways to endear your agency to your carrier underwriters and perhaps move your submission to the top of the pile, is to include a narrative or executive summary. Using hypothetical information on the input document, see the sidebar for an idea of what one narrative looks like.

In marketing the account, one of the ways to endear your agency to your carrier underwriters and perhaps move your submission to the top of the pile, is to include a narrative or executive summary. Using hypothetical information on the input document, see the sidebar for an idea of what one narrative looks like.

Not only will your underwriter love you for providing a bird's-eye view of your account, but it might also enable him/her to give you a quick “no” or “yes, we're interested” up front instead of having to endure the endless and needless waiting game.

In our next column, we'll look at how to get the most out of your marketing effort and turn to how best to manage your renewals.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.