With an historic financial services regulatory reform bill about to enter the home stretch on Capitol Hill, insurance industry groups will keep lobbying to craft an acceptable compromise in reconciling the House and Senate versions before a final bill reaches President Barack Obama's desk as soon as July 4.

The stage was set to start negotiating a final measure after the Senate voted 59-39 on May 20 to make the most sweeping changes to financial services oversight since The Great Depression.

As far as the insurance industry is concerned, the key components of the Wall Street Reform and Consumer Protection Act include provisions giving authority to the Federal Reserve Board to regulate non-banks (including insurers) under certain circumstances, along with the creation of an Office of National Insurance within the Treasury Department.

Under both the House and Senate bills, the Fed would be given oversight of a troubled insurer if a Financial Stability Oversight Council–composed mostly of federal regulators–determined that a non-bank constituted a potential systemic risk to the financial system.

Under both the House and Senate bills, the Fed would be given oversight of a troubled insurer if a Financial Stability Oversight Council–composed mostly of federal regulators–determined that a non-bank constituted a potential systemic risk to the financial system.

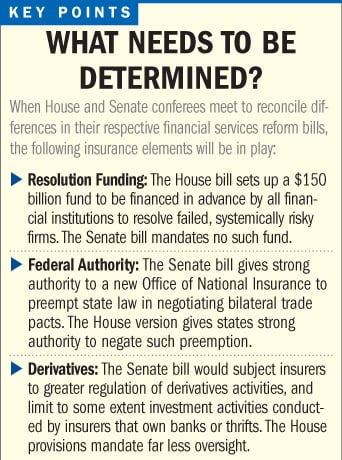

A critical difference between the House and Senate bills that will be the subject of intense lobbying by the insurance industry is that the House bill sets up a $150 billion fund to be financed in advance by all financial institutions. The money would be used by a Resolution Authority managed by the Federal Deposit Insurance Corp. to pay for the resolution of a troubled financial institution that poses a systemic risk. The Senate bill mandates no such fund.

Insurers are lobbying for a provision that would exempt non-bank financial services firms subject to liquidation or rehabilitation under state law from any assessments by federal regulators to pay for resolving systemically risky financial institutions.

Under both bills, states retain authority to regulate the business of insurance, and insurance activities are exempt from oversight by a new Consumer Financial Protection Agency.

However, the Senate bill gives strong authority to the new ONI to preempt state law in negotiating bilateral trade pacts regarding insurance with foreign countries. The House version gives states strong authority to negate such preemption.

The ONI would have the authority to compile data on insurers and the industry itself in both versions of the bill. It will also have the authority to serve as an early-warning system that would determine if an insurance company was troubled, and recommend that the Fed and a new Systemic Risk Council place it under supervision.

The Senate bill contains other provisions that would subject insurance companies to greater regulation of their derivatives activities and limit to some extent investment activities conducted by insurers that own banks or thrifts. The House provisions mandate far less oversight of these activities.

Both the House and Senate bills contain similar language reforming and modernizing the surplus lines and reinsurance markets by establishing the rules of a domiciliary state to govern regulation and tax assessment of these products. (See accompanying story.)

Ken Crerar, president and chief executive officer of the Council of Insurance Agents and Brokers, noted with satisfaction that the Senate decided not to vote on an amendment that would have forced banks to divest all insurance-related activities they conduct directly.

"Insurance sales–as opposed to underwriting–present no systemic financial risk whatsoever and have no relation to the meltdown that precipitated this congressional effort," he said.

Representatives of property and casualty groups voiced support that financial services reform retains state regulation of insurance.

At the same time, trade group officials said they would continue to monitor the bill as it proceeds to final passage to ensure that more onerous regulation of insurers is not added to the legislation.

"The regulatory reform bill that the Senate passed appropriately recognizes that the property and casualty insurance industry does not pose systemic risk," said Leigh Ann Pusey, president and CEO of the American Insurance Association. She noted that existing state-based resolution mechanisms remain in place for failed insurers, and policyholders remain protected by state guaranty funds.

Robert Rusbuldt, president and CEO of the Independent Insurance Agents and Brokers of America, voiced gratitude that the Senate and House versions both leave day-to-day regulation of the insurance market at the state level.

"Property and casualty insurers played no role in creating the crisis and pose no systemic risk to the overall economy," he said. "In fact, the state regulatory system, while in need of more uniformity and efficiency, has a proven track record of ensuring insurer solvency, industry competition and growth, and consumer protection."

Jimi Grande, senior vice president of federal and political affairs for the National Association of Mutual Insurance Companies, said "the final product of the Senate is not a perfect bill, but it is one that for the most part recognizes the unique nature of insurance and respects the state-based regulatory system."

Under the schedule proposed by Rep. Barney Frank, D-Mass., chair of the House Financial Services Committee, the House would vote on the final version of H.R. 4173 on June 29, giving the Senate three days to complete work on the bill before the recess.

Under the Frank plan, the Reconciliation Committee conference to work out differences between the House and Senate measures would begin on June 9 with its organizational meeting and opening remarks. The committee would hold five open working sessions, starting June 15 and finishing June 23. The conference would conclude June 24.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.