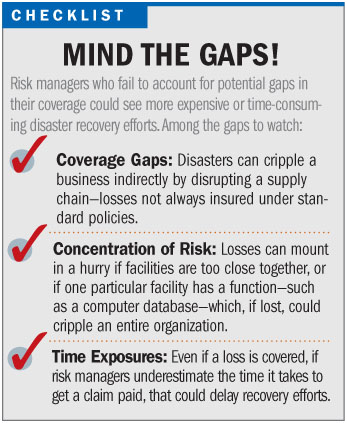

Risk managers looking to fully cover their commercial property losses and get back into business quickly after a catastrophe need to look way beyond the obvious, dissecting and accounting for a variety of potential coverage gaps, loss control experts contend.

"What we found recently is that our clients are assessing business continuity planning and wondering if there are gaps in the coverage," Allen Melton, Americas practice leader, insurance claims service, with Ernst & Young in Dallas, told National Underwriter at the annual Risk and Insurance Management Society conference in Boston late last month.

With globalization of organizations, there is more of an emphasis on supply-chain risks, he said, citing an example of a chemical company that had been getting a product via rail.

With globalization of organizations, there is more of an emphasis on supply-chain risks, he said, citing an example of a chemical company that had been getting a product via rail.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.