It should come as no surprise insurers on both the life/health and property/casualty sides of the aisle believe growing the business is the top business issue for 2010. But growth's traditional counterpoint–cost reduction–seems to be more on the minds of life/health insurers, according to Celent's “2010 CIO Survey: Pressures, Priorities, and Strategies.”

Eighty-seven percent of property/casualty insurers list growth as the top business issue for this year, with 80 percent of the life/health side following suit. From there, though, the order of priorities veers off.

For property/casualty insurers, the second priority is ease of doing business with producers (74 percent) followed by increasing profitability (42 percent), cost reduction (39 percent), agility (35 percent), and ease of doing business with prospects and policyholders (23 percent).

On the life/health side, the order consists of: cost reduction (70 percent), increasing profitability (50 percent), ease of doing business with producers and ease of doing business with prospects and policyholders (tied at 40 percent), and agility (20 percent).

So, why is there more concern for reducing costs on the life/health side?

“I think the explanation comes more from the types of pressures that were being felt by the business people at the time of the survey [October and November 2009],” says Donald Light, a senior analyst on Celent's insurance team. “In general [life/health insurers] have more real estate in their investment portfolios, and that is what hurt their results.”

As a consequence, Light points out, a frequent response of life-side senior management in the face of losses is to cut costs. In contrast, “P&C insurers–while still having some real operational challenges caused by the recession–aren't getting hit with cuts like the variable annuity insurers,” he says. “Their investment losses generally have been less.”

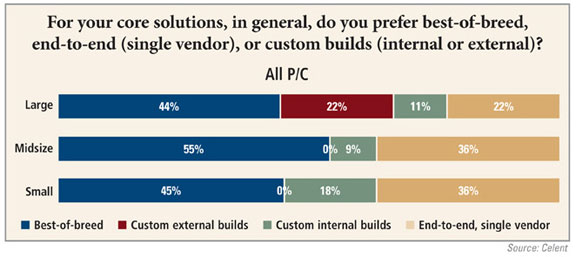

As for vendor solutions, respondents to the Celent survey show an inclination for best-of-breed solutions. On the life/health side, 75 percent of large insurers use best-of-breed solutions, with 25 percent favoring an end-to-end solution.

While best of breed is favored by all three tiers (44 percent for large, 55 percent for midsize, and 45 percent for small) in P&C, the differences in carrier size become evident in other vendor options.

None of the small or midsize carriers chose custom external builds, while 22 percent of large carriers did. The percentage of end-to-end solutions was just 22 percent for large carriers but 36 percent for both midsize and small carriers.

“The natural home of the end-to-end vendor sales is to small and midsize companies,” says Light. “The fewer vendor relationships you have to manage and worry about the better job you can do if your IT shop has only 10 to 25 people.

“The level of integration of an end-to-end solution is not completely integrated out of the box,” he notes, “but it's less of a headache. The vendor is likely to provide more assistance for future integration challenges more cheaply and efficiently than if you have a bunch of vendors in the best-of-breed world.”

– Robert Regis Hyle

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.