They Say, Hearsay

“Problems associated with Chinese-made drywall are all over the news, and now I am reading that companies may not insure homes if the owners don't repair the drywall damage. Isn't that what insurance is for — to take care of these type of problems?”

We Say

Last month, the Miami Herald reported on a Punta Gorda couple who filed a claim with their insurer, the state government's own Citizens Property Insurance Corp., asking for damages to pay for the removal of their imported drywall and for the replacement of metal appliances that were corroded, apparently by the noxious fumes from the drywall. The claim was denied, and Citizens is saying that it may not renew policies unless a homeowner removes the problematic drywall. The article quotes an attorney for the couple saying that Citizens' denial of the claim means there is a hole in the Citizens “safety net.” And, poof, the story gains traction throughout the state, as negative news reports often do, putting the insurance industry in the all-too-familiar position of explaining that property insurance is not meant to be an all-inclusive home warranty, but rather financial protection for covered perils.

With faulty installation or manufacturer defects on major electronic appliances, most consumers know to go to the source. But that recourse seems to get lost when it comes to a structure. The same news article mentioned above quotes another attorney who calls it a shame that insurers won't provide an “immediate solution” for homeowners by simply settling defective drywall-related claims, and then subrogating against the manufacturers. Everyone wants immediate solutions, right? However, this offered solution becomes an issue transferred to the insurance industry that once again puts us in the defensive position of explaining policy language and knowing that it will be challenged in court.

There is a reason insurance policies offer specific coverage for specific perils. We know what insurance policies would cost if coverage was provided for everything that could go wrong in a home. The price of a Murphy's Law policy would be astronomical. Sure, it would be all inclusive, no questions asked, no parameters to keep costs in check. The only problem is no one could afford such a policy.

As it stands now, the typical homeowners' policy is over 20 pages. If we covered everything imaginable, maybe we could cut the policy down to two pages. Then the declarations page would probably be about 20-plus pages! But the reality is, covering every peril imaginable is…..unimaginable. How could the industry ever envision that drywall could cause such problems? The Environmental Protection Agency is still investigating health claims from the drywall, and while much remains to be learned, lawsuits are not waiting for scientific determinations. For both practical and economic reasons, home insurance policies provide protection against a specific range of perils that can be priced by insurers and afforded by the homeowner.

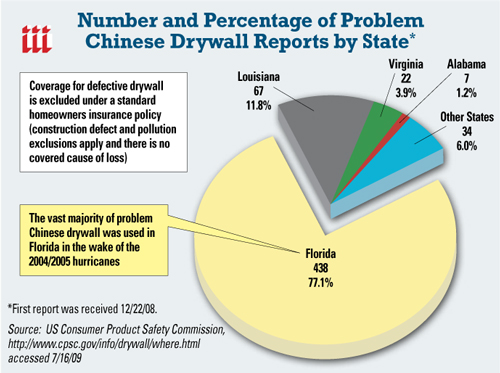

Construction materials were in short supply following the hurricanes of 2004-2005. Estimates are that 600 million pounds of drywall were imported from China, with 60 percent of the stuff going into Florida homes.

No one knew of toxic drywall before, and it is really unfortunate that we had to learn of it from people who had to go through the trauma of hurricane damage and then experience an additional problem with the repairs. That's not fair, but it also is not the fault of the insurance industry.

Many of the state's largest home builders, to their credit, have taken on the task of gutting and rebuilding homes affected by the drywall. This is being done without established protocols for remediating homes. If drywall is removed without uniform procedures based on scientific parameters, continued contamination and damage is possible. But I guess many believe that an immediate solution takes precedence over a correct solution.

Chinese drywall is purported to emit noxious fumes and damage plumbing and electrical equipment, and allegedly causes a number of health problems. Although homeowners' policies specifically exclude damage from pollution and corrosion, court cases are pending to see if the exclusions stand up.

Class action lawsuits abound, consolidated in multidistrict litigation in Louisiana. Cases are on a fast track, with the trial expected to start early in 2010. While property damage claims are expected to move quickly, injury claims make take longer to resolve.

Many people consider their homeowners' insurance coverage to be similar to the extended service contracts they purchase for major appliances. Extended service contracts were introduced by electronics stores in the late 1980s, and it is estimated that these warranties generate about $15 billion a year for retailers (according to Warranty Weeks, Jan. 19, 2005). Such warranties contribute a lot to the profitability of the nation's retailers. They are sold as a “peace of mind” policy, just like a P&C policy. That explains the warranty mentality. It also explains our ongoing challenges in educating policyholders about what their coverage is and how it works.

Lynne McChristian is the Florida representative for the Insurance Information Institute. She may be contacted at 813-480-6446, [email protected]. Also, see www.InsuringFlorida.org for her insurance blog, “Straight Talk.”

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.