Best Practices StudyFinds Keys To Agency Success

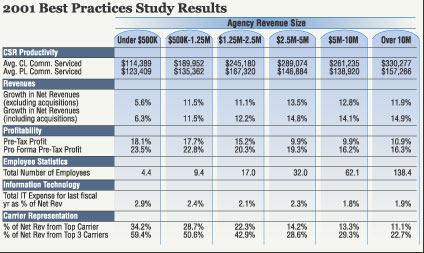

The “2001 Best Practices Study,” conducted by the Independent Insurance Agents of America and Reagan Consulting, is being released this week. Although the studys financial and operational benchmarks are updated annually, this years study is the first in three years to look at the business practices used by these agencies to achieve their outstanding results.

The top agencies in each of the studys six revenue categories were interviewed to discuss their business philosophies, core practices, and major challenges.

It is important to note that all of the interviews were conducted prior to the tragic events of Sept. 11, 2001. Although new challenges might surface as a result, the Best Practices agencies appear well equipped to proactively plan for a successful future.

It is important to note that all of the interviews were conducted prior to the tragic events of Sept. 11, 2001. Although new challenges might surface as a result, the Best Practices agencies appear well equipped to proactively plan for a successful future.

As in past years when the business practices were examined, common themes emerged irrespective of agency revenues, book of business or geographic location. The list of key business practices are familiar:

A focus on customer satisfaction, revenue growth, and strong financial management.

A commitment to developing and rewarding outstanding employee performance.

The utilization of technology to achieve efficient and effective procedures.

The nurturing of good carrier relationships.

The resources allocated and the tools used to implement these practices differed, but the core practices are essentially the same.

For smaller agencies, the focus on customer satisfaction is very personal. Clients are also local friends and neighbors who are a part of the agency staff's social and business lives. As a result, customer service is characterized by availability, quick response and extensive use of draft authority to quickly settle smaller claims.

Larger agencies also maintain personal client relationships, but because they typically have a number of different client segments to deal with, they are forced to segment their client base and tailor services unique to each.

Although it is impossible to have personal relationships with all segments, customer service is still characterized by highly professional staffs that deliver prompt and fair claims processing, timely transaction turnaround, frequent communications and a willingness to serve as the insureds advocate in a time of need.

Revenue growth is considered to be one of the top challenges for agencies large and small, even in light of a hardening market. Both groups center activities on organic growth, but acquired growth continues to play an increasingly important role for those agencies over $2.5 million in revenues and up.

All agencies, regardless of size, focus on account development through cross-selling of insurance and complementary value-added products and services. Niche and program marketing is a key growth strategy mentioned by most of the agencies interviewed in each of the six revenue categories.

Sound financial management is a given for Best Practices agencies. While the tax laws encourage owners of smaller, privately held agencies to take money out of their business as opposed to building up the balance sheet, these agencies nevertheless are excellent at managing their receivables, keeping sufficient trust balances, and investing properly the cash they have.

Likewise, larger agencies excel at invoicing agency-billed transactions on a timely basis and at receivables management. They use investment sweep accounts, cash flow planning and other effective cash management tools. They do operational budgeting, capital planning and acquisition analysis. They closely track agency profitability and productivity, and base their decisions on sound financial analysis.

Best Practices agencies readily acknowledge the important role their employees play in the agencys success. As such, they continuously invest in their employees ongoing professional development and personal growth. Most consider the recruitment of new agency talent to be a major challenge and work hard to retain their quality employees. The result is very low turnover.

When hiring a new employee, these agencies put a great deal of time and effort into hiring the “right” person, and then cultivating an environment where the employee is encouraged to contribute on many levels and rewarded for outstanding performance. Pre-employment personality profiles, employee referral programs, continuous professional development and competitive compensation packages are just a few of the practices used.

Technology is an integral part of an agency's ability to implement efficient workflows and their ability to communicate effectively with employees, clients and carriers. E-mail and voice-mail are standard tools, along with maintaining complete client and policy databases, which are used for efficient transaction processing, account development and risk management.

Upload and download are used for personal lines, and increasingly for commercial lines. Scanners, integrated fax capabilities and other technology-based tools have found their way into Best Practices agencies.

Even the smallest of the agencies have Web sites and are using high-speed access to the Internet for communications, marketing and research. Transactional filing, form letters and documents, and other timesaving devices are so commonly implemented as not to be noteworthy.

Perhaps the one new issue to surface regarding technology is the reevaluation of voice-mail usage. While voice-mail is considered an important tool, many of the agencies we interviewed are changing procedures to prevent customer frustration with being caught up in voice-mail menus and not being able to reach a live person when desired.

The practices used to ensure good carrier relationships are grounded in an agency's desire to partner with insurers that share the same values and objectives. From that foundation, agencies work to represent their carriers fairly and honestly, to provide a steady stream of business that carriers want, and to make it easy for carriers to do business with the agency.

Joint planning, whether initiated by the carrier or the agency, and an abundance of communication with multiple contacts at the carrier are key practices that allow agencies to continuously evaluate whether goals and values remain in alignment.

For smaller agencies, one of the greatest challenges is providing the volume needed to satisfy carrier appetites. As a result, the cultivation of personal relationships within the company and a conscious effort to support a limited number of carriers are considered critical practices. Interestingly, the larger agencies consider the same practice as critical to their success.

All of the agencies interviewed were asked what issues “kept them awake at night.” Most responded that they slept well, but did feel challenged by the need to stay current regarding technology, to steadily grow their revenues and to bring new talent into the industry.

In spite of changes in both the industry and the economy, Best Practices agencies are optimistic about the future.

Shirley Lukens is a consultant and principal with Reagan & Associates, an independent Atlanta-based management consulting firm working with insurance agents, brokers and companies.

Reproduced from National Underwriter Property & Casualty/Risk & Benefits Management Edition, October 29, 2001. Copyright 2001 by The National Underwriter Company in the serial publication. All rights reserved.Copyright in this article as an independent work may be held by the author.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.