The shared economy has been growing for a number of years andit's only likely to dominate going forward. As technology'srole in the shared economy continues to expand, individualshave grown accustomed to the numerous benefits that come withit — convenience, flexibility and cheaper costs,among others.

|But the shared economy also comes with a number of risks, andfiguring out who is responsible is a critical question for anyparty involved. To answer such a vast question, Lloyd's commissioned a survey conducted byresearch agency Coleman Parkes to learn more about how all partiesinvolved in the shared economy perceive and manage the risksinherent in the sharing economy model around the world.

|Related: Lloyd's of London CEO says insurance policies atrisk without Brexit fix

|Mapping out the benefits and risks

Among the 5,000 individuals surveyed across the U.S., U.K.and China, clear regional differences emerge between the threecountries.

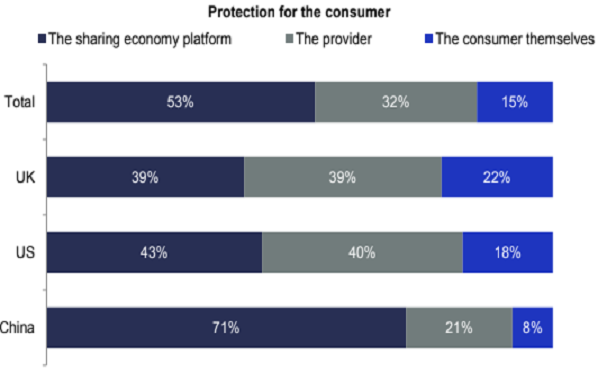

For 58% of consumers in the U.K. and U.S., the risks outweighthe benefits of using the services. Chinese consumers are morepositive with 68% perceiving greater benefits thanrisks. There were mixed reviews on whether the shared platformor provider should provide protection for the consumer; there weresimilarly mixed views on who should provide protection for theprovider.

|While there is no consensus regarding who is responsible, 53% ofrepresentatives indicated that consumers should provide insurancefor themselves in the event something goes wrong.

|Related: Here's what risk managers need to know about theEU's GDPR

|Traditional insurance might not work

Some of the risks sharing economy companies are not dissimilarfrom those of their traditionalcounterparts — property damage, businessinterruption and cyber attacks, among others. Insurers havelong provided insurance solutions for 'tangible' physical assets,but assets in the shared economy are often intangible, such asintellectual property, trust and reputation.

|The sharing economy model requires a different approach to riskmanagement based on understanding the behavioral economics ofconsumer preferences and attitudes during risk.

|Lloyd's found that 71% of consumers globally would be morelikely to use sharing economy services if insurance was offered;70% also noted they would be more likely to considersharing or offering a service if insurance was offered.

|While the number of services and assets are sure to increase,the sharing economy has a long way to go before the benefitsoutweigh the risks in the eyes of most. Its will remaincontingent on the confidence that consumers and providers have inthe market, and how the insurance industry prepares to adapt.

|Related: 8 core levers risk managers can use to maximizeliability protection

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.