Getting auto-insurance consumers to embrace telematics has been a tough sell so far, Progressive's president and CEO acknowledges, but he stresses that the company is up to the challenge and that it is committed to finding an effective message that speaks to customers.

In a transcript of a conference call with analysts yesterday, posted by Seeking Alpha, Progressive's Glenn M. Renwick said, regarding the insurer's commitment to its telematics product, Snapshot, “We're not turning back.” He added, “The real issue is we're just going to keep body punching until we find a combination of messages that really makes sense because we think there is still a latent demand out there that, if they knew more and appreciated the benefits…then we win in a big way.”

He noted strong retention among current Snapshot customers who realize savings, and stated that Snapshot will help the insurer get the “right kind of customers” who will remain with the company longer.

But getting to that point has been challenging, Renwick acknowledged. He said, “I will tell you that getting consumers to engage in a product that, for the most part, they were never asked to engage in…it's a bigger burden than, I think, intellectually, many of us might have assumed.”

But getting to that point has been challenging, Renwick acknowledged. He said, “I will tell you that getting consumers to engage in a product that, for the most part, they were never asked to engage in…it's a bigger burden than, I think, intellectually, many of us might have assumed.”

Noting that the figures are a bit dated since the survey was done “some time ago,” Renwick said when Progressive went to the marketplace and surveyed people from an “are you interested?” perspective, just 30 percent said yes. Another 30 percent said maybe, but they need to know more, and 40 percent said no. “So think about that as the challenge,” he said.

Reaffirming Progressive's commitment to Snapshot, Renwick said, “We're going to keep going. And this is a battle worth winning.”

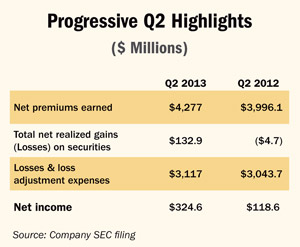

For 2013's second quarter, Progressive says net income was $324.6 million, up by 174 percent over the $118.6 million in net income reported a year ago.

While losses and loss-adjustment expenses were up slightly during the period — $3.1 billion compared to $3 billion a year ago — that was more than offset by a rise in total revenues to $4.6 billion compared to $4.2 billion in 2012's second quarter. The jump in revenues was due in part to an increase in net-premiums earned ($4.3 billion in 2013's second quarter compared to $4 billion in 2012) and total net realized gains on securities of $132 million, compared to a $4.7 million loss a year ago.

For the first six months of the year, Progressive's net income was up by 68 percent to $633.2 million, compared to $376.2 million in 2012's first half.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.