Florida's last-resort insurer has approved an average statewide rate increase in 2014 of 7 percent.

The Citizens Property Insurance Corp. Board of Governors on June 26 approved the rates, which include the continued phase-in of rate increases for sinkhole coverage.

The approved proposed rates not head to the Office of Insurance regulation for approval.

Citizens, the largest property insurer in the Florida, says homeowners not in need of sinkhole coverage are slated for an average 6.6 percent increase. The average personal residential premium in 2014 is estimated to be $2,112.

By law, rates hikes for non-sinkhole coverage cannot exceed 10 percent but sinkhole coverage is not subject to the statute.

Actuaries at the state-run insurer recommended a 27.3 percent rate increase for sinkholes but the board approved a plan to slowly phase in increases. In Hillsborough County, for example, rates will go up by 50 percent of the indicated need.

CEO Barry Gilway says the board's actions “represents a measure approach” and it “continues to make the tough but necessary decisions while recognizing the impact on Citizens policyholders.”

The insurer has been trying to get closer to actuarially-sound rates in order to decreases the risk of assessments on all Sunshine State policyholders should a large storm strike and Citizens need additional funds to pay claims.

Citizens says it collected just $56.7 million in sinkhole premiums a year ago but estimates losses to be $187.7 million. Therefore, because sinkhole coverage is not properly priced, losses from sinkholes are robbing the insurer's coffers to pay for other types of losses, such as for a hurricane.

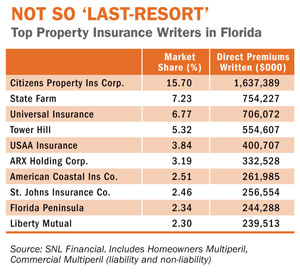

Citizens is additionally trying to reduce the amount of policies it has on the books. It was never intended to become the largest property insurer in the state but due to mandated rate suppression and other factors, Citizens has remained in competition with the private marketplace and has typically been the cheaper option for home insurance.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.