For years, poor public relations have hindered insurers' fight against fraud, but that could be changing. Public awareness programs, legislative proposals, and a string of high-profile busts are not only challenging long-held misnomers but also seem to be raising social consciousness. One need only look to a recent public opinion survey for some encouragement.

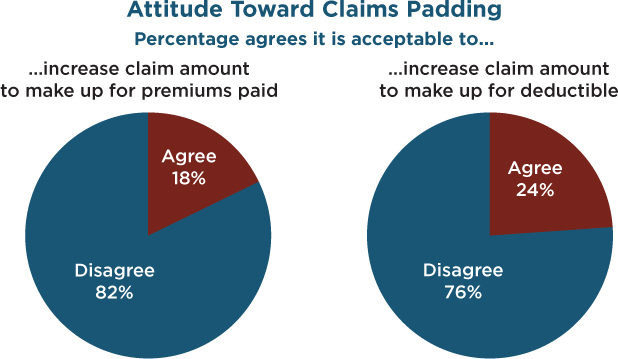

According to new findings from an online Insurance Research Council (IRC) public opinion study, the number of Americans who believe it is acceptable to pad an insurance claim is, in fact, dwindling. Twenty-four percent of IRC survey respondents believe it is okay to increase an insurance claim by a small amount to make up for deductibles they are required to pay, compared to 33 percent in a 2002 telephone survey. Additionally, 18 percent believe it is acceptable to increase a claim to make up for premiums paid in previous years when they had no claims, the lowest percentage since the question was first asked in a 1981 in-home survey.

Unfortunately, the younger respondents, especially males, were less inclined to view claims padding as wrong or at least distasteful enough to forego such a crime. For example, among males between the ages of 18 and 34, 23 percent think it is acceptable to increase claims amounts to essentially compensate for premiums, compared to 5 percent of their older (male) counterparts, and just 8 percent of females aged 18-34.

Unfortunately, the younger respondents, especially males, were less inclined to view claims padding as wrong or at least distasteful enough to forego such a crime. For example, among males between the ages of 18 and 34, 23 percent think it is acceptable to increase claims amounts to essentially compensate for premiums, compared to 5 percent of their older (male) counterparts, and just 8 percent of females aged 18-34.

The IRC study, Insurance Fraud: A Public View, 2013 Edition, also found that 86 percent of Americans agree with the statement “insurance fraud leads to higher rates for everyone,” while 10 percent agree that “insurance fraud doesn't hurt anyone.”

“The decline in the public acceptance of fraud is encouraging,” says Elizabeth Sprinkel, senior vice president of the IRC. “However, the fact remains that nearly one in four Americans are tolerant of claims padding behavior that has direct implications for claims costs and the cost of insurance for consumers. Moreover, one in ten believe that insurance fraud doesn't hurt anyone, indicating the need for continued public education.”

Respondents demonstrated strong support for fraud-fighting efforts. Two-thirds (66 percent) approved of legislation to limit attorney and medical provider access to police accident reports for the purposes of soliciting new clients or patients, a marked increase from 2002. Eight in ten were willing to participate in claims processes that could help insurers detect and prevent fraud, such as examinations under oath (85 percent) or independent medical exams (80 percent). Eighty-two percent agreed that persons who commit insurance fraud should be prosecuted to the fullest extent of the law, although the consequences favored for specific fraud activities were generally less severe than in 2002.

The 2012 results are based on an online survey IRC conducted in June 2012 among 2,005 adults across the country. Survey results were weighted by known demographic distributions to ensure that the final results were representative of the total U.S. adult population.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.