Insurance broker Marsh says global insurance rates continued to firm during the first quarter.

According to its Global Insurance Market Quarterly Briefing, Marsh says the first three months of 2013 marked the fifth consecutive quarter of global rate increases.

In The U.S., most major insurance lines saw increases of between 2 percent and 4 percent while rates decreased an average of about 1 percent outside the U.S.

Marsh notes that insurers have restricted coverage for flood-exposed property in the aftermath of Superstorm Sandy. Insurance carriers are pushing for rate increases, especially in the Northeast, says Marsh.

Property rate increases of more than 10 percent were typical in the Northeast—the region most affected when Sandy made landfall at Southern New Jersey on Oct. 29, 2012. The year prior, the same area was affected by Hurricane Irene.

Moderately catastrophe-exposed programs renewed insurance contracts with flat rates, or with increases of up to about 10 percent, Marsh observes.

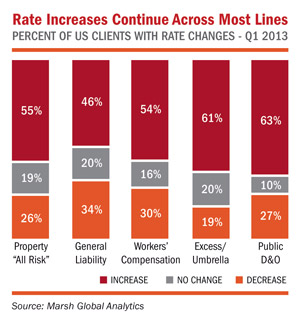

The broker says 55 percent of U.S. clients faced a rate increase for property risk during in the first quarter.

Outside the U.S., insurance capacity was “comparatively greater” since 2012 was a relatively quiet year for natural catastrophes. Rates in areas where there had been significant catastrophe losses—Australia and Japan, for instance—began to stabilize.

“Increased capacity was seen again for [global] property catastrophe risks, stifling the efforts of some insurers to secure rate increases,” reports Marsh, adding that some large insurers “showed a much greater appetite for this risk anbd are looking to expand market share.”

EPLI Rising

Marsh's tracking of rates for employment practices liability insurance shows more and more clients are absorbing rate increases after several years of rate decreases.

Marsh says 68 percent of clients had a rate increase in the first quarter, continuing a steady upward trend of EPLI rate increases. Last year during the first quarter, 36 percent of clients were faced with EPLI rate increases.

“Typical employment claims, such as race and gender discrimination, are occurring with high frequency, particularly as regulators focus on systemic discrimination,” notes Marsh.

Social media risk looms for insurers and employers, who may be getting some solutions when it comes to wage-and-hour risk. New solutions are entering the market.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.