NU Online News Service, Aug. 14, 11:45 a.m. EDT

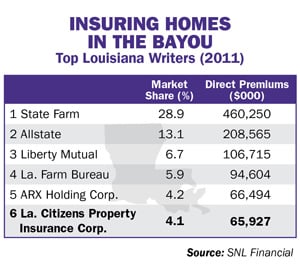

Louisiana Citizens Property Insurance Corp. is attempting to fully put the past behind it by authorizing its attorneys to begin settlement talks with disgruntled policyholders from the 2005 hurricane season.

After exhausting all avenues within multiple levels of the state court system, the state's last-resort insurance company seeks to settle with separate groups from two class-action lawsuits.

"We thought we had the right to challenge these claims individually, but the courts have not agreed," says Richard Robertson, Citizens chief executive officer, to PC360. "Now the [Citizens] board has decided to start the process of trying to put all of these claims behind us by starting settlement talks for the remaining claims."

"We thought we had the right to challenge these claims individually, but the courts have not agreed," says Richard Robertson, Citizens chief executive officer, to PC360. "Now the [Citizens] board has decided to start the process of trying to put all of these claims behind us by starting settlement talks for the remaining claims."

The problem is that Citizens does not know exactly how many homeowners will come forward looking for a piece of a proposed settlement.

The state-run insurer is already locked into paying a nearly $105 million judgment from a long-fought battle in a case involving more than 18,500 policyholders who say Citizens did not begin adjusting their claims within a 30-day time limit after hurricane Katrina and Rita. The original judgment was for $92.8 million, but the amount has grown to about $105 with interest as Citizens fought the court decision.

More policyholders can join the class, and this additional group is being targeted for a possible settlement. Robertson says plaintiffs' attorneys say an additional 7,500 could be standing in line for a payout.

The other class-action suit alleges Citizens did not timely pay undisputed losses to homeowners after the hurricanes. Citizens had been trying to decertify the class in this suit and could have tried to take its case to the state Supreme Court. But with recent history in mind, the board has chosen it would "be more prudent to settle," says Robertson.

Two law firms representing Citizens are expected to bring a "framework of proposed settlements" to the board by its next meeting in September, says Robertson, who adds that Citizens has access to the funds needed to pay the judgment already levied against it as well as settlements to resolve the remaining claims.

He says payments from the $105 million judgment likely won't be doled out until the end of the year since a distribution plan needs to be laid out first.

But state Insurance Commissioner Jim Donelon has called the award to policyholders a "potentially devastating event" because it puts the last-resort insurer of coastal properties at a disadvantage, especially if the state is hit with a hurricane.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.