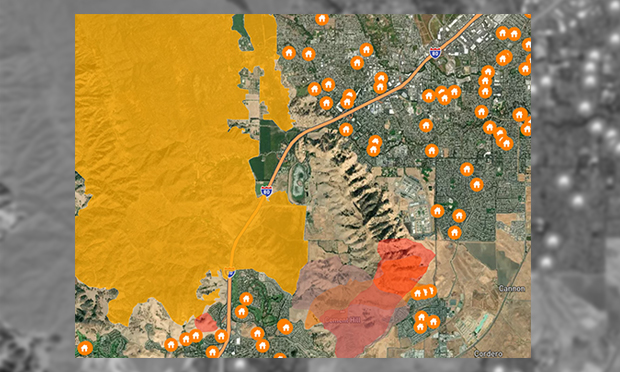

Evolving natural disaster risk reveals a less obvious yet far-reaching consequence for insurers: Traditional methods of managing risk concentration can't keep up with a constantly changing risk landscape. (Credit: BuildingMetrix)

Evolving natural disaster risk reveals a less obvious yet far-reaching consequence for insurers: Traditional methods of managing risk concentration can't keep up with a constantly changing risk landscape. (Credit: BuildingMetrix)

The 2018 Camp Fire in Northern California left behind devastation in many forms: burned-out businesses, incinerated homes, charred cars. In total, the fire destroyed nearly 19,000 structures and claimed the lives of 85 people. The blaze also caused another casualty: A regional insurer was forced into liquidation in part because it had taken on too much risk in areas affected by the fire.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.