While more risks exist in the energy industry than ever beforeand challenges to underwriters have never been as great,opportunities still abound for insurers willing to do their duediligence in a market that is constantly evolving.

|Which is not to say that insuring clients in the energy marketis without its perils; clients in some sectors are facing greaterexposures than they've seen in years. It doesn't help that oil hita 12-year low earlier this year, when the price per barrel fell below $27: Anoversupply of oil translates to lower prices per barrel, which inturn means that energy companies can't afford to make upgrades totheir assets.

|Billion-dollar losses

Many of those companies affected by the downturn have deferredasset maintenance and upgrades over the past several years, saysPascal Ray, senior vice president, marine and energy programsmanager at USI Insurance Services in Houston. That has resulted ina rush of claims that approach and even top billion-dollarlosses.

|During the 2015–2016 Los Angeles Aliso Canyon gas leak (alsoreferred to as the Porter Ranch gas blowout), forexample, an estimated 97,100 metric tons of methane and 7,300metric tons of ethane were released into the atmosphere, making itthe worst single natural gas leak in U.S. history. Losses to SoCal Gas are at $700 million andrising. According to reports, the source of the leak was adecades-old metal pipe some 8,750 feet below ground level that hadnot been considered a danger.

|Wave of claims in near future

Ray predicts that the energy industry will see a wave of claimsin the near future because of deferred and delayed maintenance,upgrades and integrity testing of a company's crucial assets ofwells, pipelines and refineries. “The downturn in the [oil]industry has forced cutbacks in maintenance and asset integritytesting, which is most likely going to manifest itself in assetintegrity-related claims,” he says.

|Those strained resources, says Ray, also can cloud executives'judgment when it comes to crafting the policies that protect theirbusiness: “Many companies can't afford to buy the insurancecoverage they need, forcing risk managers into difficult decisionsbased on survivability,” he says.

|Clients, however, still need the proper coverage, whether it's adrain on their finances or not — and agents may see thismarket's current environment as an opportunity.

|Extremely thorough underwriting and asking the right questionsof the client are critical for survival in this market. Increasedcompetition has led to a soft rate environment in the energymarketplace, with more players — but not always ones that possess adeep bench of expertise.

|“The challenge is that there is a tremendous amount ofcompetition to write business,” says Todd Westcott, vice president,underwriting energy product line manager at Vela Insurance Servicesin Atlanta, a part of W.R. Berkley Corp. Westcott concurs thatrates are continuing to go down as capacity remains abundant inthis market.

|More risk

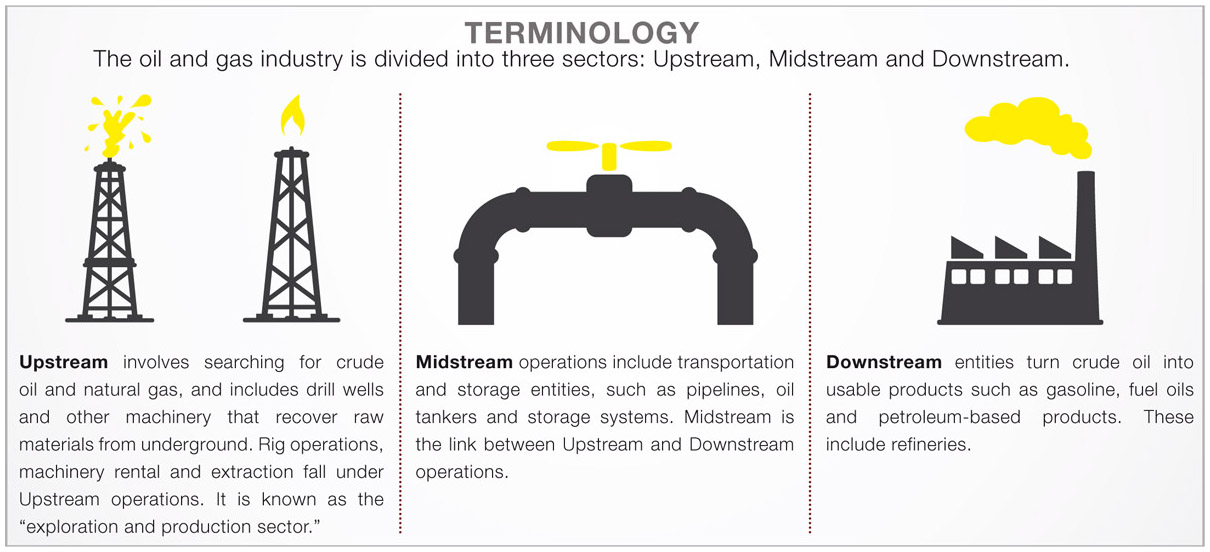

The soft market created by this increased competition maycontinue to soften into the near future except in the midstreamsector (transportation and storage entities, such as pipelines, oiltankers and storage systems), where rates may flatten, says Ray.The U.S. and Canadian midstream sector has been hit with an“unusually high” number of large pipeline losses this year, hesays, which has caused more stringent underwriting and rating ofthese accounts.

|“More risk exists now than ever before,” Ray adds. “One thingall companies can do to reduce the uncertainty of one of theirgreatest risks — asset integrity — is to focus resources on themaintenance and testing of their assets to help prevent them frombecoming the next member of the billion-dollar claims club.”

|Related: Invisible natural gas spill in California costingmillions, making people sick

||Far-reaching exposures

Cyber risk is a serious danger in many sectors on the energymarket, and the exposures extend far beyond the usualconsiderations of data loss.

|According to “Business Blackout,” a joint report by Lloyd'sof London and the University of Cambridge's Centre for RiskStudies, it would cost more than $1 trillion to the U.S. economy ifmalware shuts down parts of the power grid in the northeasternUnited States, leaving 93 million people in the dark.

|The 2015 report, which examines a hypotheticalcatastrophe of a 50-generator blackout that affects 15 northeasternstates, also predicts a rise in mortality rates as health andsafety systems fail, a decline in trade as ports shut down,disruption to water supplies as electric pumps fail and chaos totransport networks and infrastructure collapses.

|Electrical power generation and distribution companies areseeing exposures as demand for their products increases in thewestern states, says Ric Pena, vice president of HartfordFinancial Service Group's energy practice: “The drought, coupledwith demand, has resulted in wildfire incidents and the resultingfirst- and third-party exposure.”

|Related: Energy companies need insurance cover for cyberattack 'time bomb'

||

Natural risks

Additionally, in areas of the United States that face exposureto such natural risks, earthquake activity may be tied into theenergy industry. Pena says this “is an area to watch carefully andmonitor,” as there are new exposures centered on upstreamwastewater injection operations. Oil and natural gas can be foundin porous rocks, particularly in Oklahoma, for example. Duringextraction, saltwater is produced. This “oilfield brine” can behandled through saltwater disposal wells, in which it is injectedback into the ground. However, there's a risk that this wastewatercan be injected into fault lines.

|Westcott says that Vela Insurance Services is starting to seeclaims related to this, “and when we look at loss runs, they haveearthquake reserves.”

|Pena notes that the energy market is transitioning from anoil-and-gas boom era to a more balanced, diverse, evolving economy.“Upstream oil and gas has been most impacted by the globaloversupply of oil, but the midstream and downstream sectorscontinue to perform well,” he says.

|Ray agrees that limited opportunity exists in the upstreamsector because of a substantial drop in drilling activity.“Companies in this sector, in many cases, are buying less insuranceand retaining more risk,” Ray says, and in some cases “taking onmore risk than their company can financially survive in the eventof a large loss.”

|As such, midstream and some downstream companies are viewed asbetter opportunities in this sector, “as they continue, for themost part, to fully insure their assets,” Ray adds.

|Get schooled

The best way to develop expertise in the energy insurance marketis through on-the-job experience, pairing up with a seasonedprofessional who can provide mentoring, Ray says.

|Due to the energy market's size, agents and brokers should“really pick an area of focus — decide where your expertise liesand then go deep into that area,” adds Pena. “The agents andbrokers who can partner [with carriers] best and 'go deep' are thebrokers who will be the most successful in the energy sector.”

|The University of Texas Petroleum Extension “Rig School” alsooffers week-long oil and gas education courses, in addition to theInternational Risk Management Institute, which now offers an energyrisk and insurance specialist series of courses that leads to acertification.

|The Houston Mariners conference and the IRMI Energy Risk andInsurance Conference both cater to a wide range of issues in theoil and gas industry, and the Texas and Oklahoma IndependentInsurance Agents associations also provide energy insuranceeducation opportunities, Ray adds.

|Related: Energy & specialty insurance: A healthymarriage

||

Solar energy installations are expected to grow 64 percentin 2016, nearly double that of wind energy. (Photo:Shutterstock)

|Renewable energy picture

Meanwhile, renewable energy sources continue to grow in the U.S.According to the Washington-based Solar Energy IndustriesAssociation, solar energy grew 64 percent and wind energy grew 33percent in the first quarter of 2016 alone.

|The renewable-energy insurance marketplace “really revolvesaround wind or solar,” explains Pete Wilcox, national underwritingofficer for renewable energy at Travelers Cos. solar energyprojects, he notes, “can basically be built anywhere.”

|Wind turbines, Wilcox says, require acres of land and cost muchmore to build than solar farms, which can be harnessed throughpanels installed on nearly any surface, including buildings andlandfills. Solar also is being integrated into building materialssuch as solar windows and roof tiles.

|The lower product and installation costs, and the greater bangfor your buck that comes with solar energy, is translating toincreased opportunity in the property and casualty industry.“There's a lot of competition in the marketplace,” says Wilcox.“Domestic insurers and the global market all want to insure thatsolar space because it is such an attractive commodity — it haslower maintenance and upkeep than a wind turbine will have.”

|There's less competition for wind farms, which are increasinglybeing consolidated by utility companies — which, in turn, wrap thefarms into their existing policies. Additionally, there's lessinterest from private investors in wind farms because of the scaleof resources and cost to create them.

|For large utility-scale wind farms, “there's less competitionjust because of the sheer limits that people are looking for,” saysWilcox. “It's not uncommon for a wind farm to cost $200 million —I've seen them higher than a billion dollars. So that really thinsout the competition, or competition starts working together toinsure those on a quota share-type arrangement.”

|Growth may not continue past 2023

While renewable energy is expected to continue to grow at a fastpace, Wilcox and Eileen Kauffman, head of global renewable energyat Travelers, agree that growth may not continue past 2023, whenthe federally mandated Solar Investment Tax Credit will drop tozero. (Currently, the credit is 30 percent on residential andcommercial properties.) According to the Solar Energy IndustriesAssociation, the investment tax credit has helped solarinstallations grow an average of 76 percent each year since beingimplemented in 2006. “If the ITC isn't updated [in 2023], then alot of solar will start slowing down,” says Wilcox.

|“The new administration will have an impact on clean energy,”adds Kaufmann. “There's going to be development over the nextcouple of years, but it could drop off after the ITC ends.”

|While a slowdown in renewable energy installations can result ina decrease of new business on the insurance side, Wilcox explainsthat the marketplace will always be needed for existingproducts.

|“The thing is, all of the existing [installations] out there arestill going to need to be insured,” he notes. “That marketplacewill still be there because the solar energy system sitting on topof a factory is typically not owned by the factory building owner:It's owned by somebody else. So that's always going to have to haveinsurance on it.”

|Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.