Can two of the world's largest economies catch up to the United States in terms of usage-based insurance (UBI) adoption? China and Brazil, with their respective technological and infrastructure advances coupled with policy trends and other economic factors, may very well do so in a short period of time.

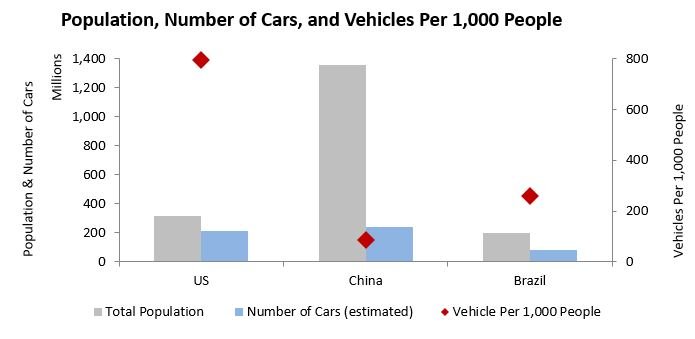

A better question might be: Are the two countries anywhere near overtaking the United States on the UBI front? At first glance, that would seem unlikely. When compared with China and Brazil, the UBI market in the U.S. is considerably more mature — more than a decade has elapsed since the first commercial UBI program was introduced into the American marketplace. Indeed, with more than 2.6 million UBI policies written in the U.S. (as of mid-2014), nearly 50% of the world's total UBI policies reside there. But future projections for growth in connected cars, population, and new vehicles on the road suggest a potential exists for UBI adoption to expand exponentially in China and Brazil — especially in China — over the next few years (see Figures 1 and 2).

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.