In 2011, buyers enjoyed a relatively soft market for their Employment Practices Liability Insurance (EPLI). But the pricing pendulum is swinging this year, with insureds seeing, in some cases, increases inching into double-digit territory.

For all businesses, regardless of size, decreases in EPLI pricing last year outweighed increases. According to insurance broker Marsh's most recent benchmarking trends report on EPLI, 44 percent saw their EPLI insurance decrease by an average of close to 2 percent, while 35 percent saw no change; just 21 percent saw their rates increase.

For all businesses, regardless of size, decreases in EPLI pricing last year outweighed increases. According to insurance broker Marsh's most recent benchmarking trends report on EPLI, 44 percent saw their EPLI insurance decrease by an average of close to 2 percent, while 35 percent saw no change; just 21 percent saw their rates increase.

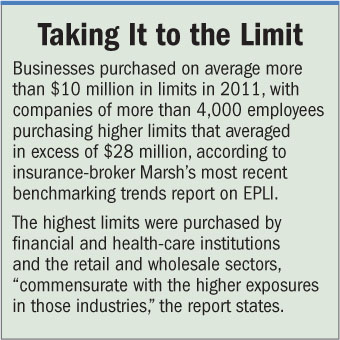

Larger companies, especially, benefited from carrier competition on their EPLI risk in 2011, according to the Marsh report: 58 percent of large organizations (4,000 or more employees) received rate decreases in their coverage last year. That translated into close to 4 percent average rate decrease for the year. Only 14 percent of large companies saw rate increases; 28 percent saw no change.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.